Following on from the mainstay declines in Bitcoin and the crypto exchanges this week has seen the collapse of Tethers TerraUSD stablecoin which triggered a huge sell-off in digital-asset markets most popular tokens e.g. DeFi favourite Avalanche plunged 34% and Solana 30%. I can imagine a number of subscribers are asking what are stablecoins:

- Stablecoins are digital assets which are designed to retain their value. Tether for example sells their tokens / coins for $1 which it then guarantees to buy back for $1 if customers want to redeem. Theoretically, they do this by pegging the coin to the $US and crypto assets using hedging algorithms.

The trouble is hedging can only go so far when consumer confidence stampedes in one direction and in the case of TerraUSD (UST) the result has been frightening this month with prices plunging to 45c, I would hate to be a forced buyer of something for $1 that was trading at 45c! There are currently dozens of stablecoins whose market value was over $185bn late last year. They exist simply as a bridge between crypto land and traditional finance, they should be a streamlined and efficient way of using bitcoin etc through different exchanges but so far this is an unregulated marketplace and problems like this weeks are likely to expedite changes on this front.

The short term issues with giant Tether who reportedly have $US69bn in assets is around whether they keep their promise to maintain the 1:1 exchange rate, something which is really hard to comprehend in a free market world especially as the company is backed by large short-term loans out of China!

Message 3: only invest in assets/stocks that you fully comprehend.

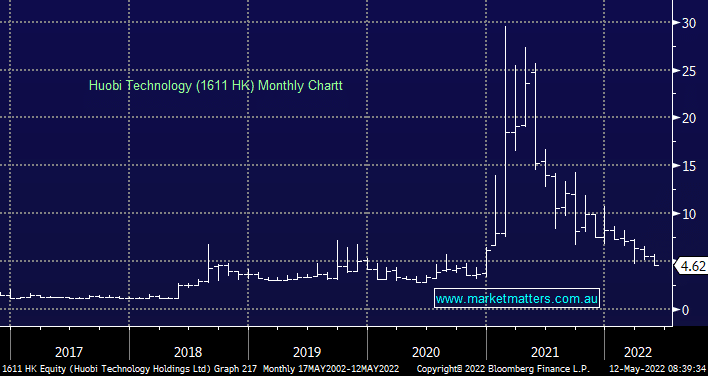

Asian listed Huobi (1611 HK) has its own stablecoin which has certainly not helped performance over the last year.

The first half of 2022 looks set to deliver a huge relative performance victory for defensive style investments – definitely not crypto currencies! While there will be twists in the road we believe this trend will be maintained into 2023 hence any strong bounce in high growth / valuation stocks should be considered as selling opportunities.

Message 4: Keep it simple in the current volatile environment, quality businesses are the way to invest i.e. portfolios should almost have a boring bias.