HUB delivered another cracking result yesterday, underscoring its position as one of the fastest-growing wealth platforms in the country:

- Earnings: Underlying NPAT climbed 44% to $97.8m (vs $93m expected)– margins continue to expand as scale kicks in.

- Flows & FUA: Net inflows were a record $19.8b, helped by large migrations ($5.3b from Equity Trustees and $1.3b from ClearView). Total FUA finished FY25 at $136.4b, up 30% year-on-year, with platform FUA alone growing 34% to $112.7b.

- Dividend: A fully franked 32c final dividend takes the full-year payout to 56cps, up 47% on last year.

- Advisers: Added 572 new advisers, the biggest gain since FY21, with adviser penetration now at 33% and FUA per adviser lifting to $22m (from $14m in FY21).

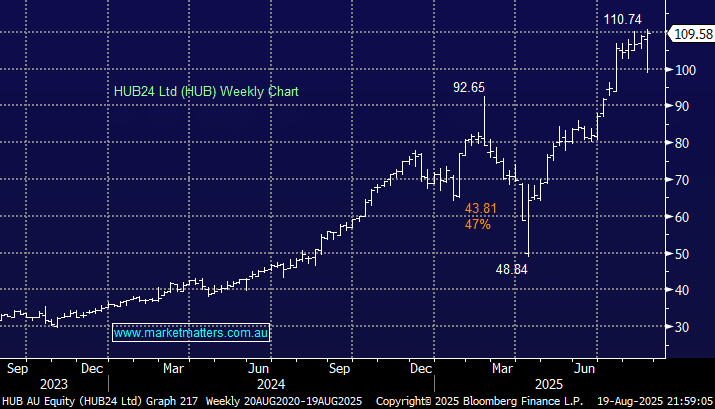

This was an excellent set of numbers across the board – earnings, flows, and adviser adoption all beat expectations, with dividends up sharply. HUB continues to win market share at pace, proving that its platform proposition is resonating with both advisers and clients. The only slight negative was a rise in operating costs (+18%), but given the top-line momentum and strong inflows, the market quickly recovered from this early surprise, using the initial dip as a buying opportunity. As always, execution remains the key, and HUB has shown again that it can deliver.

- HUB is one of the genuine growth stories on the ASX: MM owns HUB in its Active Growth Portfolio.