Alternative asset manager HMC has switched its attention to data centres announcing a $300mn capital raise to put towards its $1.93bn acquisition of Sydney data centre owner Global Switch Australia – no big surprise this was flagged earlier in the month in the media. The firm has signed terms for the Global Switch Australia acquisition, and will use it as the foundation asset for a digital infrastructure portfolio spanning Australian and US assets. In addition to Global Switch HMC are understood to be in advanced talks for several other US assets including the $400mn iseek data centres where its competing with QIC. With the Chinese selling out of Global Switch the timing is ideal for HMC to move into the red-hot data centre market especially with the assets attractive proximity to Sydney’s CBD.

- If HMC is successful in the coming months the ASX’s biggest IPO this year will be its data centre REIT, knocking Guzman Y Gomez off its perch.

- We like this fresh direction by quality operator HMC, it offers ASX investors another solid alternative for data centre exposure.

For background HMC has previously pulled off several headline-grabbing deals, including orchestrating a reverse listing of pharmacy giant Chemist Warehouse through Sigma Healthcare where it owns a stake. Last year, it turned its attention to digital infrastructure, acquiring US-based digital infrastructure asset manager StratCap.

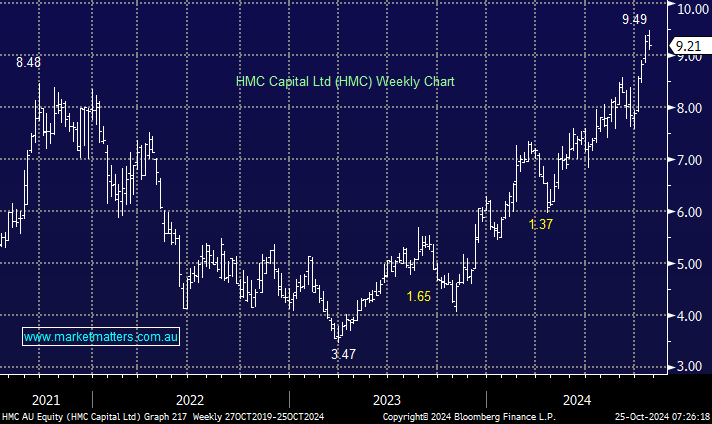

- We have been fans of HMC though we’ve clearlybeen too pedantic on price, another stock headed for our Hitlist and potentially Active Growth Portfolio.

We have been active in the data centre space through 2024, enjoying strong gains from Goodman Group (GMG) and recently dipping our toe into NEXTDC (NXT), the question today is where to from here as the “picks and shovels” start to the AI boom takes shape.