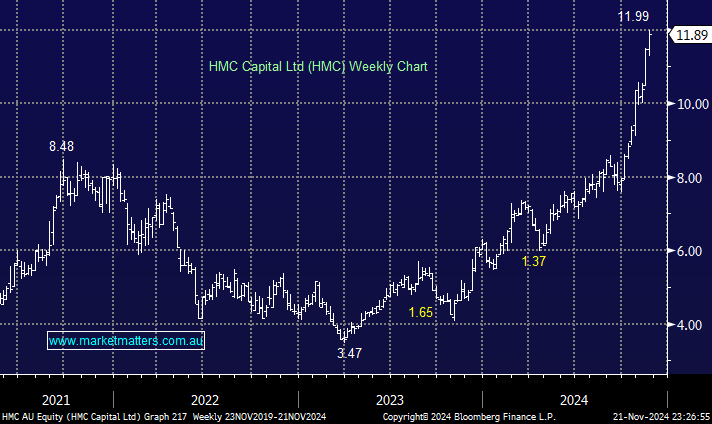

HMC Capital has performed strongly in 2024, driven by significant strategic moves and financial growth, including platform expansion and acquisitions such as Global Switch for A$2.12 billion to capitalise on the growing demand for data centres driven by AI and high-performance computing (HPC) needs. Also, in FY24, HMC reported a 40% increase in operating earnings per share and a 30% growth in assets under management, reaching A$12.7 billion. This solid financial foundation has supported its ability to fund and scale new ventures, i.e. the strong getting stronger.

HMC is positioning itself nicely to benefit from robust new megatrends, such as the growth in alternative assets, digital infrastructure demand, and sustainability-focused investments. Until further notice, the company has the confidence of investors that it can execute – not a given on the ASX!

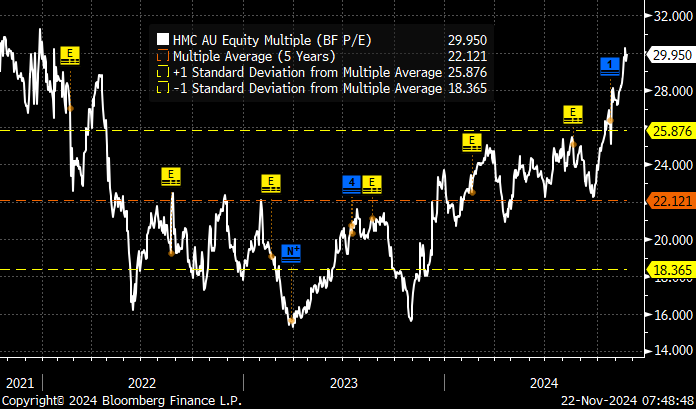

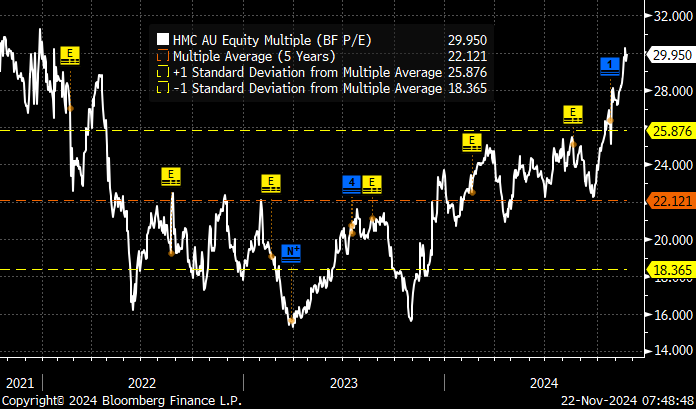

- We like HMC, but it’s comparatively rich, trading around $12.

This alternative asset manager has made a dramatic and successful foray into the data centre space, affording investors on the ASX an alternative to NEXTDC and Goodman Group (GMG). However, we are very conscious that having “data centre” on its menu has driven up the valuation of HMC in a couple of months – we have been surprised by this dramatic re-rating. However, following the massive demand for its new Digico REIT the move is easier to fathom.

- We think the Digico REIT is likely to list at a premium this month, adding relative value to alternatives in the space.