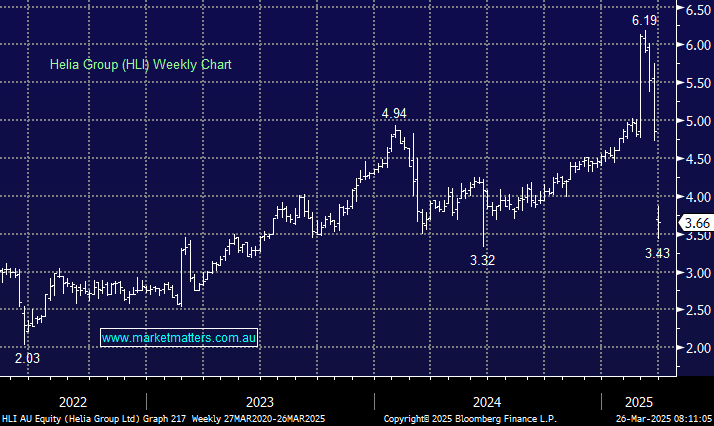

We covered HLI earlier in the week (here) as the stock fell ~25%. It appears highly likely that they’ll lose their exclusive contract with CBA as the provider of choice for Lenders Mortgage Insurance (LMI), which accounts for around 44% of their Gross Written Premium (GWP). We now ponder what this could mean for HLI, given there are offsets when an insurer loses business, in so far as it reduces the amount of capital they need to hold and, therefore, brings into play the prospect of aggressive capital management, something we think is now on the cards for HLI.

- Clearly, the loss of the CBA contract is a negative for HLI’s longer-term growth rates. They will ultimately have a smaller business, with declining revenue and earnings, but this won’t happen for a few years. It was a well-documented risk for HLI, something we’d flagged and the main reason why we did not press the buy button for the Income Portfolio.

HLI is now trading around ~1x price to net tangible assets (P/NTA). NTA is the total physical assets minus its total liabilities and intangible assets. We think that’s ‘about right’ in terms of valuation, subject to confirmation that they’ll actually lose the CBA contract. On top of that, they have unearned profit, which is contracted earnings they recognise over the life of the insurance cover, i.e. not when a policy is sold. Macquarie estimates that at $1.60/share.

The upside now is around capital generation in the short term, and then lower capital needs in the medium term. That sets up the prospect for capital returns, assuming claims continue to remain low. Lower earnings won’t necessarily mean lower earnings per share (EPS) if HLI aggressively buys back stock, as they have already been doing. On Macquarie’s numbers (noting that we believe MQG’s coverage of HLI has been very good over the years), they project a decline in profit of only very mild magnitude for FY25, 26, and 27, before the earnings hit comes in FY28 (an 11% decline) and FY29 (a 20% decline). This makes sense as earnings for the next three years are largely locked and loaded.

However, due to the likelihood of aggressive share buy-backs, Earnings Per Share (EPS) should increase between FY25-28 at an average of 7% pa, before declining 2% (only) in FY29 when the full earnings hit is felt.

- While buy-backs address EPS, dividends will also be significant with MQG forecasting special dividends of 40c in FY25 & FY26 and 20c in FY27, on top of the 32cps ordinary, both fully franked. On their numbers, this equates to a ~20% dividend yield in FY25 & 26, dropping to 14% in FY27.

NB: HLI are a December year-end, recently reporting FY24 results, which included a total of 84cps of dividends during the year – not bad for those that paid ~$3 for the stock in June 24 when CBA put their business up for tender!