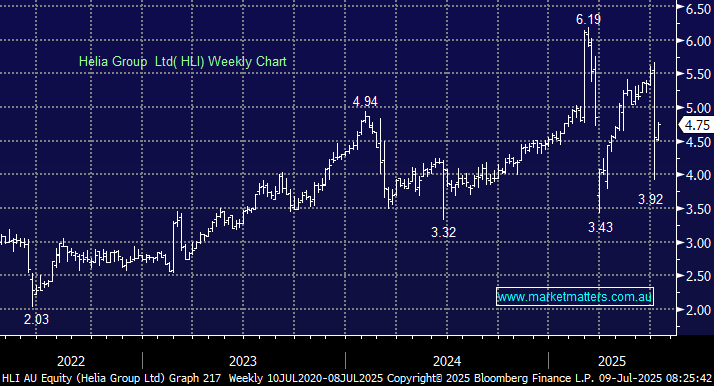

We bought HLI in the Income Portfolio last week, starting with a 2.5% weighting. While the stock has been on the Hitlist before, it was not listed there when we purchased it. The buy was prompted by a sharp ~26% fall in the share price following the likely loss of another major lender’s mortgage insurance (LMI) contract, this time from ING. This comes on the heels of Commonwealth Bank (CBA) cutting ties with HLI in March, at which time the shares fell by a more aggressive ~40%. The CBA contract was larger, accounting for 44% of their Gross Written Premium (GWP) relative to ING’s, which accounts for ~17% of GWP. There are not many stocks we would buy after they lose up to ~60% of their earnings potential in the blink of an eye, however, HLI has some important offsets.

When they lost the CBA contract in March, the initial hit to the share price was largely recouped in ~3 months, on the expectation that the loss of business would be mostly offset by an equivalent return of capital. The same methodology can be applied to the loss of the ING contract, which should prompt an even more aggressive stance towards dividends and buy-backs. Their back book will also keep generating earnings from both CBA and ING for several years to come. HLI targets a Prescribed Capital Amount (PCA) coverage ratio of 1.4-1.6x, which is the amount over and above the amount determined by APRA.

They currently have ~$1.7bn of capital on their balance sheet, in excess of the required ~$840mn. Assuming 1.6x PCA on a significantly smaller book, we estimate there could be ~$600m or so that can be returned to shareholders over the coming years, equating to ~$2.20/sh.

- This is not a simple stock to analyse, and there are many moving parts to this. Losing 60% of GWP in a year is a big hit, and there will need to be some material changes to the business, cutting fixed costs and right-sizing operations for the new norm. They are also looking for a new CEO after Pauline Blight-Johnston announced she would stand down after more than five years in the role. The catalyst seems to be her contentious share sales before news of the CBA contract loss hit, which clearly should be examined.

Due to these complexities, we’ve taken a smaller-than-usual position in the more conservative income portfolio, but we do believe this will be a strong income stock in the coming years, albeit with more volatility than may be comfortable at times.