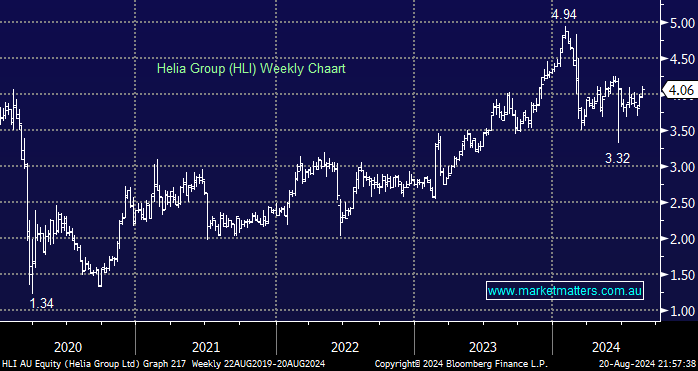

The mortgage insurer reported 1H24 results yesterday that were solid, with an underlying net profit after tax of $106.5m and a fully franked interim dividend of 15cps, equating to a 3.7% yield for the half, or 5.2% inclusive of franking. With considerable excess capital on their balance sheet, we think HLI is in a strong position for further capital management, publicly stating their preference for fully franked dividends, then on market share buy-backs, and lastly, special dividends when profits for a particular period are high. This likely capital management is why HLI resides on the Hitlist for the Active Income Portfolio, though yesterday’s move back up through $4 is not ideal.

In terms of the size of potential capital management, they have the capacity to buy ~$100m of stock back each half, which is significant given 280m shares on issue (market capitalisation of ~$1.2bn) i.e. buying 16% of issued shares back in a year would be very supportive. They have a current $100m buy back in place, with $92m to buy before 31st December 2024.

We also like hearing from HLI about the state of the market; they generally provide good insight into the housing and mortgage markets. A few key points:

- New business volumes remain soft, driven by low levels of high loan-to-value ratio (LVR) mortgage lending, which is the impact of the Federal Government’s First Home Guarantee scheme. i.e. fewer people are gearing up over 80% to buy houses.

- National dwelling values rose 3.7% in 1H24 and are at record levels. Dwelling values have risen in most geographies, including Western Australia and Queensland which have historically had higher levels of portfolio negative equity. i.e. gains are broad across the country – no clear pockets of weakness.

- The resilience of the Australian labour market continues to be a key positive, which is leading to a very low level of defaults.

While growth on this market is hard to come by, they did highlight a renewed focus on growing and defending LMI market share, which implies they will go very hard at renewing CBA’s business, which has been put to tender (HLI is the incumbent).

- We continue to like HLI and see big ongoing dividends and buy backs, though nearer $3.70 is our preferred buy level.