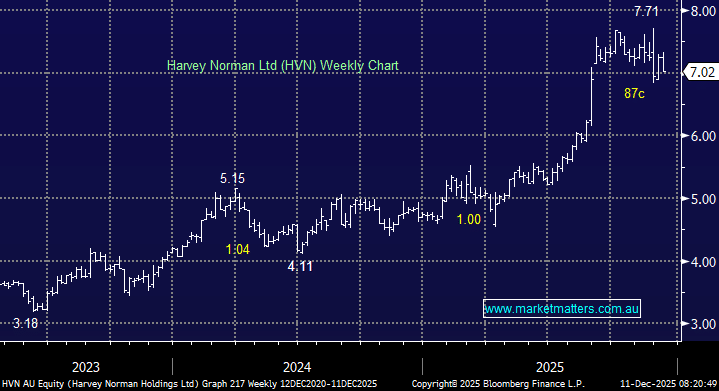

We liked the result from HVN in September which saw the stock re-rated on the upside. The company, which operates under the Harvey Norman, Domayne, and Joyce Mayne brands, delivered a strong outlook after reporting nearly 10% sales growth in July and continued momentum across its eight international markets. Also, we shouldn’t forget that HVN enjoys a business model similar to McDonald’s as a major property owner, where “Burgers drive revenue, but property drives profits”. However, both of these tailwinds are likely to be crimped with rates forecast to rise in 2026, hence we’re not buyers at current levels.

From a valuation perspective, HVN on 17x is around ~15% expensive in our view, and still pricing in rate cut tailwinds, not the potential for two hikes in 2026.

- We will consider the retailer on a pullback nearer $6 if it were to eventuate.