When you walk into HVN, the first thing you see is furniture, although they have a diverse revenue mix which is very exposed to the Australian consumers appetite to spend. Additionally, they should enjoy a tailwind from new products (e.g. AI across all computers & electrical) although the benefits look likely to be more long-term than near-term skewed. We also think investors are under appreciating their international business that has greater growth potential.

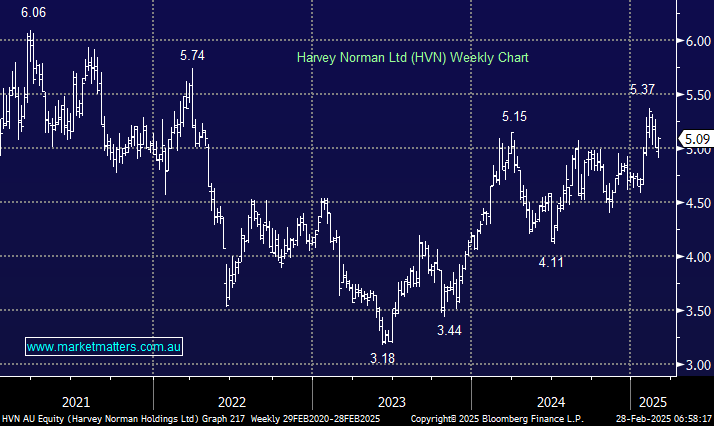

The stock has enjoyed a solid move over the last 18 months, and it is trading on the rich side above $5. Todays 1H25 result will be an important read on whether the strength can continue, however the macro in improving. Earnings should benefit from rate cuts and so should its stock as the ~4.3% fully franked yield becomes more attractive on a relative basis.

- We like HVN around $5, initially targeting ~10% upside, depending on today’s result.