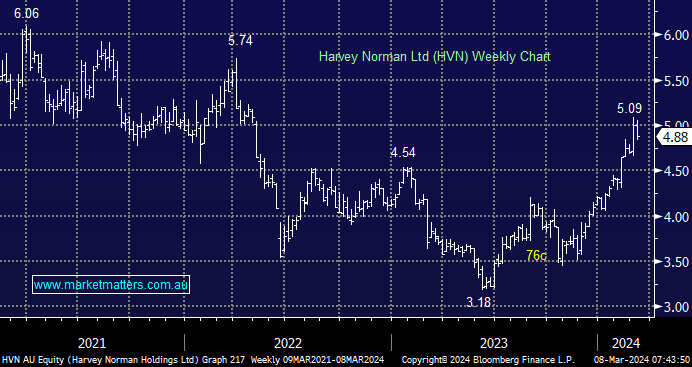

HVN has tried to break above $5 following its better than feared half-year report. Revenue matched expectations, while margins were better than hoped, driving Profit Before Tax (PBT) of $289m, a 12% beat to expectations. This is an encouraging turnaround in the 2Q, which has been reflected by the strong move in the stock. With the franchising operations outlook improving after a challenging period, improvement is expected to continue as HVN leverages its exposure to the customer cohorts we touched on earlier. HVN is expected to expand into England in late CY24E, which, if executed correctly, will add value to the business. At the same time, the stock is not as cheap as it was but it’s not scary at this stage of the cycle.

- We like HVN from a risk/reward perspective if it drifts another 7% lower.