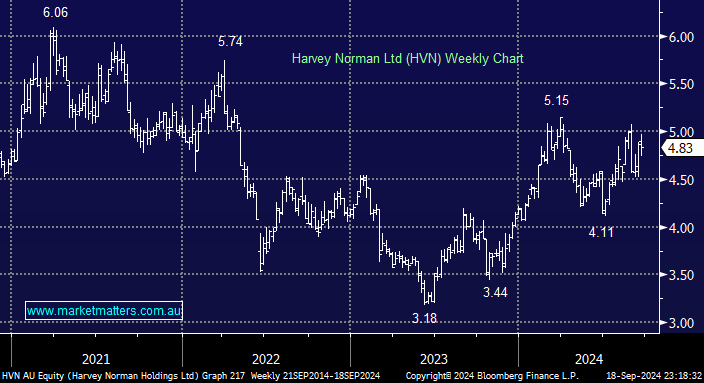

We have slowly warmed to HVN over recent months on valuation grounds, although we still prefer JBH as a business. We cannot ignore the price side of the equation, and after gaining +15% year-to-date compared to JBH’s +51%, it’s easy to see its comparative appeal.

- We like HVN into dips, targeting a test of $5.50 into 2025.