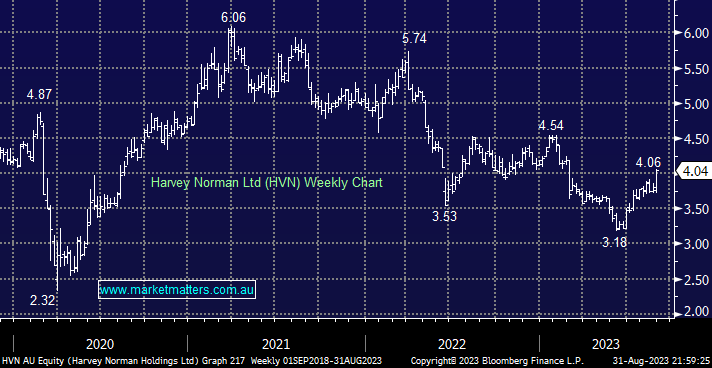

HVN rallied +5.2% yesterday after the retailer delivered FY23 net profit of $539.5mn which while down -34% year-on-year was well ahead of consensus at $461.5mn – consumer-facing stocks continue to outperform expectations. Some analysts also commented that the company’s franchise segment exceeded expectations, with 6.2% of the stock held short we could see a short squeeze unfold after it’s almost halved from its 2021 high.

- We believe the next ~10% for HVN is on the upside which is attractive when combined with an estimated 6.4% fully franked dividend over the next 12 months.