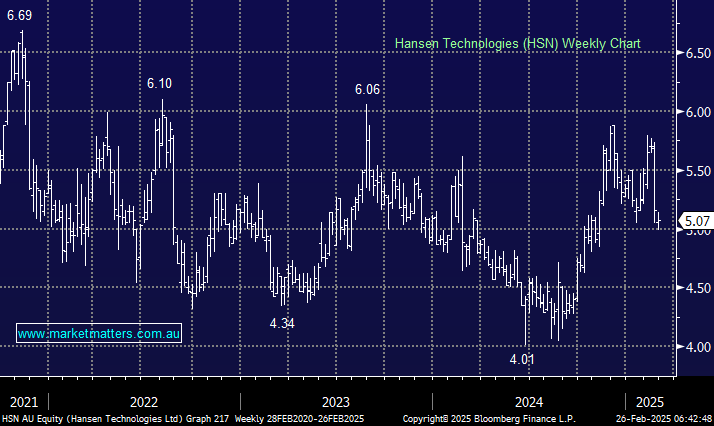

HSN’s stock price has fallen -10% since releasing its 1H25 result, which MM thought was a good one when we covered it here. We note there have been some mixed opinions written about it since, with a bearish thesis doing the rounds that highlighted a decline in their core business as a reason for concern. As a refresher, the provider of billing systems software in energy & telecommunications bought a German business called Powercloud in February 2024, which was losing money, about ~$20mn pa.

HSN turned that around a lot quicker than they thought, and it’s no longer losing money – which is a positive. However, they maintained (rather than upgraded) their FY guidance. On face value, that implies the existing business was weaker, hence the market sell-off. We caught up with management yesterday and questioned them on this. The straightforward response was around the timing of revenue recognition as opposed to weakening trends. A delay in timing means the 1H suffered, but the revenue will fall into the 2H, creating a bigger 2H skew.

They reconfirmed guidance for EBITDA of $76-85m, and we think the top end is very achievable. The prospect of an upgrade in the next 3-4 months is a strong possibility.

- Therefore, we think the post-results sell-off is overdone, with weakness presenting a buying opportunity.