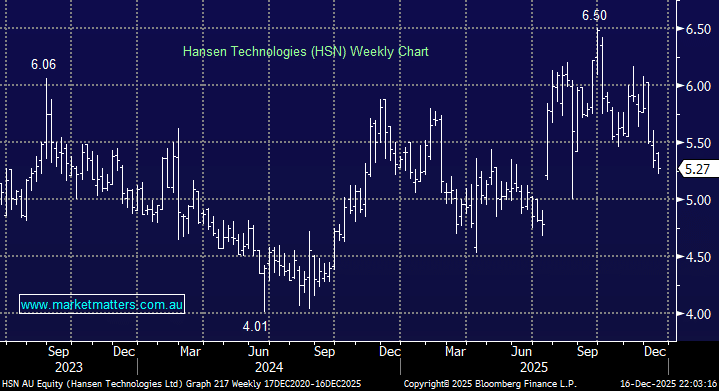

We continue to own Hansen Technologies (HSN) in the Emerging Companies Portfolio, and in line with recent selling in tech, the share price has been under pressure since peaking at $6.49 in September, now down nearly 20%. As a refresher, HSN develops and licenses billing & customer management software for utilities (energy, water) and telcos.

Our original investment case for HSN centred on three key pillars:

- Predictable, recurring earnings growth driven by long-dated SaaS and support contracts

- Operating leverage as scale increases and legacy cost bases are rationalised

- Disciplined M&A, targeting niche, high-quality software assets that enhance product depth and customer reach

These three elements remain intact, with the recently announced Digitalk acquisition reinforcing point 3.

The acquisition price of $66m (EV) at ~10x earnings (EBITDA) was a good deal we think, and is a natural extension of Hansen’s strategy, providing exposure to the fast-growing MVNO market of the global telco market (stands for Mobile Virtual Network Operator) – think Amaysim, Boost Mobile & Aldi Mobile. MVNOs are structurally gaining share globally due to lower cost and more flexible offerings, making this a genuine growth area.

Digitalk is a founder-led, high-quality SaaS business with 10%+ p.a. revenue growth over the past three years with expanding margins. The acquisition includes a cloud-based billing and CRM platform serving incumbent telcos, challengers, and new digital entrants, dovetailing nicely into HSN’s current offering.

We like to buy stocks that are executing well, but come off due to broader market weakness – and this is certainly the case with HSN. On UBS post-acquisition estimates, they have FY26 revenue growing at +7% YoY to $420m and cash EBITDA of $107m, up +14% on FY25. From a valuation perspective, HSN remains attractive, trading at a discount to the broader small-cap market while the balance sheet is in good nick, providing scope for further accretive M&A.

- HSN remains a high-quality software business priced at an attractive valuation.