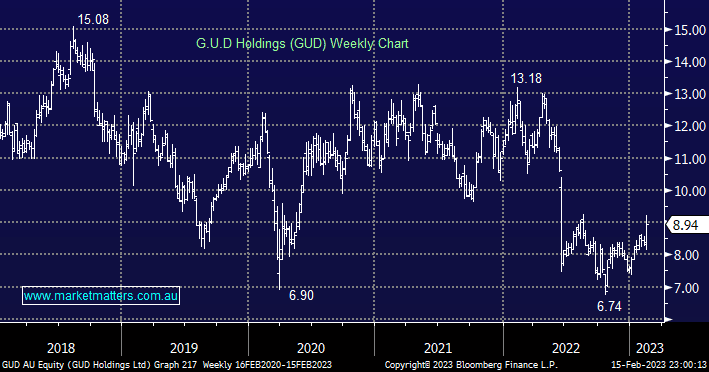

For those not familiar with G.U.D Holdings (GUD) it manufactures industrial goods like electrical appliances, auto parts, and water systems. The stock closed up +8.1% yesterday after reporting a +55.7% lift in revenue and a +88.5% increase in NPAT plus a 17c fully franked dividend to be paid later this month. Strength in its core automotive business delivered a stronger-than-forecast result helped by low inventory levels and strong order books into Q4. GUD’s 1H23 result was in line with consensus, however, market expectations were low heading into the result and importantly earnings downgrade risk concerns should now have abated.

- We’ve had GUD on our Hitlist for a few weeks and Wednesday’s strong earnings report justified this but we’re reticent to chase into strength due to the company’s dependency on the consumer.