Overnight, Goldman Sachs’ traders maintained the trend set by its peers, posting their highest quarterly revenue on record, helped by strong equity trading – the stock rose ~2% following the result. The results built on a record year for Goldman in 2024 when the New York-based bank lifted its revenue in its equities division by almost 50%.

- Equity trading revenue surged +27% from a year earlier to $4.19 billion.

- GS’s top-line revenue came in at $15.1 billion, beating analyst expectations of $14.8 billion.

- Return on equity for the quarter was 16.9%, higher than estimates.

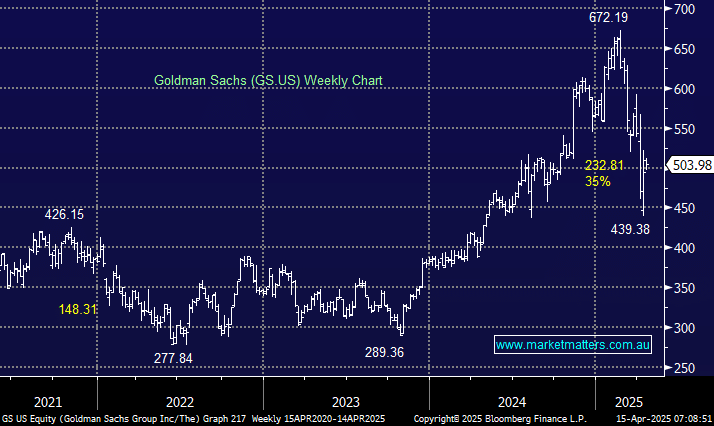

The stock remains well below its 2025 high, and although the stock is now trading above its average valuation of the last 5 years, we believe it’s justified after this impressive quarterly.

- We can see GS trading significantly higher through 2025: MM owns GS in our International Equities Portfolio.

We like the US banks following these strong quarterly results, though subscribers often ask, ‘what’s your preference?’. Here goes:

- GS, JPM, MS and WFC, but we particularly like the first two.