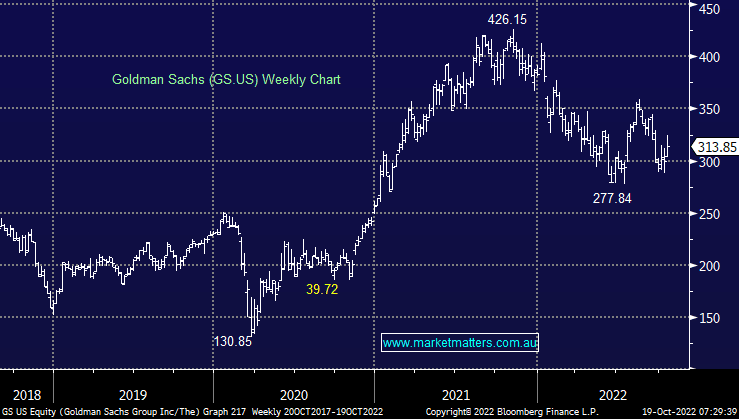

Goldman Sachs (GS US) was the last US investment bank to post quarterly earnings overnight and there is always a lot to learn in these numbers. They give us insight into how the biggest investment banks in the world are seeing things, more importantly through their actions rather than their rhetoric, while most of them also have large high street operations giving insight into the health of the important US consumer. Firstly, the results were better than expected across the sector but they generally are, so that’s not a big learning. Their high street operations are performing well, implying the US consumer is in good shape. Investment banking is down significantly, implying no deals are getting done while revenue from trading was up given the volatility. What was most telling though, was that Goldman, Morgan Stanley, Citi., JPMorgan and Bank of America all reported headcounts that were up from the previous three months and a year earlier. Of the six largest banks, all of which reported financial results in the past week, only Wells Fargo cut the size of its staff. This is not typical of banks that see a deep and painful economic contraction on the horizon.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is now bullish GS ~US$310

Add To Hit List

In these Portfolios

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.