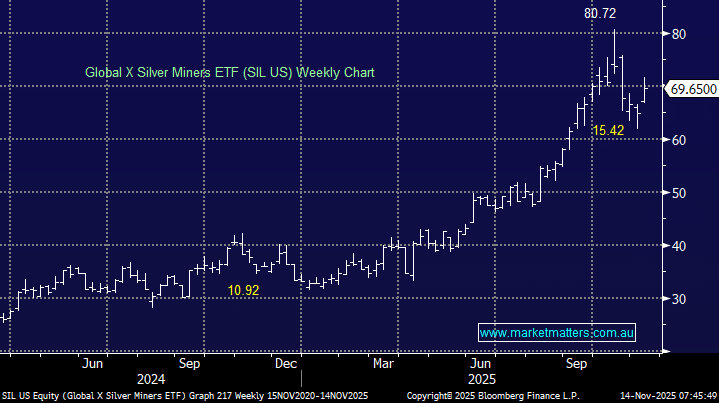

There’s little more to add to the silver story beyond what we’ve covered for gold, but silver also has significant industrial applications, plus at times it can be more volatile. The US-traded SIL ETF is a great vehicle to gain exposure to global silver miners, especially as they are thin on the ground on the ASX:

- The ETF holds 45 stocks, with its 5 largest positions currently Pan American Silver. Coeur Mining, Hecla Mining, Fresnillo, and Industrias Penoles.

- From a regional perspective, it has 63% exposure to Canada, followed by 18% to the US, 10% Mexico, and 4% South Korea.

- It has a large substantial market cap of $US3.7bn, while its fees are okay at 0.65%.

Again, we expect a choppy ride over the coming weeks, but MM believes the underlying bull market is alive and well.

- We believe the SIL ETF continues to represent good risk/reward buying in the 65 area, but again, this may increase in the coming weeks if the ETF continues to stabilise.