This US-traded COPX ETF is basically the same product as the WIRE ETF, just listed in the US with a few additional holdings. This would suit investors wanting to retain Copper/mining exposure in $US – i.e. not translating it back to $AUD on a marked to market basis as the WIRE ETF does.

It tracks the same Solactive Global Copper Miners Total Return Index with the same cost structure as the WIRE ETF, and generally holds mostly the same stocks at the same weightings. While the WIRE and COPX after issued by the same provider, it is not actually the same fund.

COPX has $US1.8bn invested in it vs $290m for WIRE, and COPX has been around longer. We think The COPX ETF is well-positioned for global electrification over the coming years, a trend we believe in strongly.

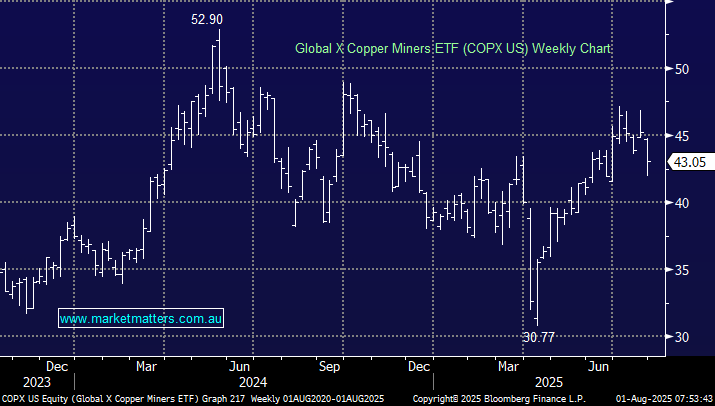

- We like the risk/reward towards this ETF as it consolidates around the $43 area, ultimately targeting a retest of $53.