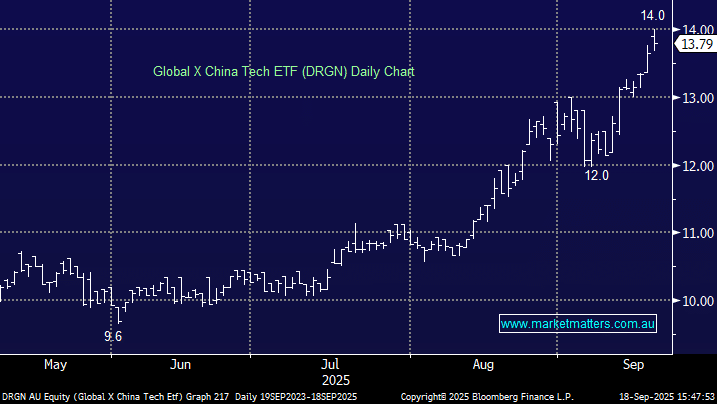

This ASX listed ETF has only been listed since May, driven by market conditions and demand as they usually are. DRGN gives investors exposure to ~20 leading Chinese technology companies listed in both Mainland China (A-shares) and Hong Kong (H-shares) across ~15 innovation-/technology-linked sectors. Liquidity is still modest, but with a cost of 0.45% this ETF provides good exposure to a basket of stocks that many retail investors find challenging at a very reasonable fee.

- The DRGN ETF tracks the Global X China Tech 20 Index, with it’s largest 5 holdings in Alibaba, Hygon Information, Tencent, Xiaomi Corp, and Meituan.

- The ETF has tracked its benchmark very well in the short time it has existed: Over the last three months, it has gained +36.1%, while its benchmark is up +36.5%.

This pocket of global equities has surged over the last few months, but we believe it’s the start of a new structural bull market in both AI and China-facing names.

- We like the DRGN ETF over the coming years, but note its very concentrated play, holding 21 stocks.