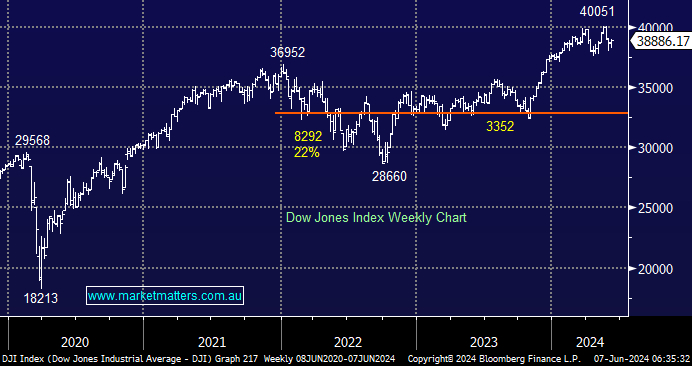

US stocks have entered a holding pattern ahead of tonight’s jobs report, but our preference is that the Dow will ultimately make new highs in a similar fashion to the S&P500 and NASDAQ. It’s likely to be a simple game tonight; if the employment data comes in around expectations or slightly weaker, it will be good news for stocks, but other extremes could raise concerns around interest rates or a potential recession.

Economists expect the Bureau of Labor Statistics to show that the U.S. economy added 190,000 more jobs in May, slightly up from the previous month. While the average hourly earnings are expected to show a 0.3% increase, slightly higher on the month, putting the 12-month increase at 3.9%.

The wage numbers will probably garner the most attention in a week when Australian unions are pushing to raise teen pay by 42% – I’m sure it would have made sense to all of us in those glorious years, but their timing isn’t ideal with inflation the main game in town.

- We are ideally looking for the Dow to make another assault above 40,000 in the coming weeks.

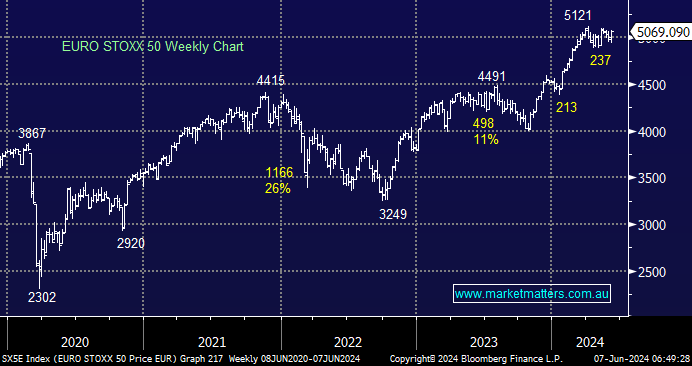

Lagarde et al. at the ECB delivered the much-anticipated rate cut overnight, although there was no mention of another one any time soon. European equities have enjoyed strong gains through 2024, and although there’s always the risk of a “buy on rumour, sell on fact” event, we must give the bull market the benefit of the doubt as stocks knock on the door of fresh all-time highs.

- Our ideal target area for the EURO STOXX is the 5300 area, or 5% higher.