Overnight, US stocks enjoyed a strong session as war jitters appeared to abate, with crude oil falling ~2.5%. The S&P500 ended up +1.3%, delivering its best performance since August, with communications services outperforming courtesy of stocks like Netflix (NFLX US), Warner Bros. Discovery (WBD US) and Verizon Communications (VZ US) all surging well over +3%. The move felt like a “post-Friday relief rally”, with all 11 main sectors advancing after no fresh negative news arose over the weekend, the Fed rate decision is looming on Wednesday with no change to rates anticipated, while Apple Inc (AAPL US), the S&P500’s largest constituent, will report its earnings on Thursday, the stock is already down 15% from its 52-week high.

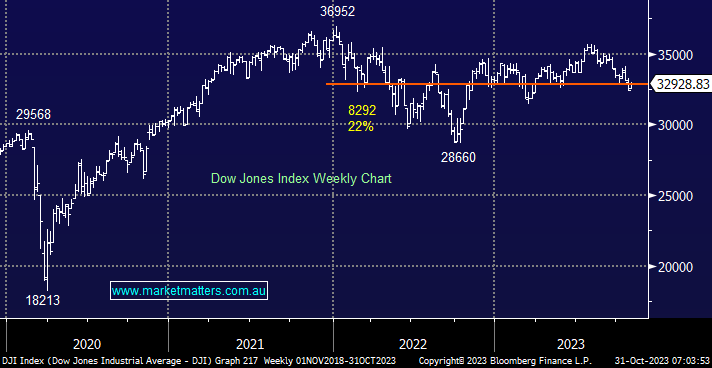

- The Dow is trading in the middle of its 2-year range, but the picture could look very different by the end of the week, with plenty of news set to cross our screens in the coming days.

Investment Bank Goldman Sachs (GS US) popped almost +4% on Monday, but a quick look at the last few years shows the investment bank remains close to recent lows after correcting ~35% from its 2021 high. This is a quality company, but we see no reason for it to outperform into 2024, i.e. a similar outlook to MM’s view on the Australian Banking Sector.

- We remain in a market where the strong are getting stronger, which suggests there’s no reason to chase Goldmans at this juncture.