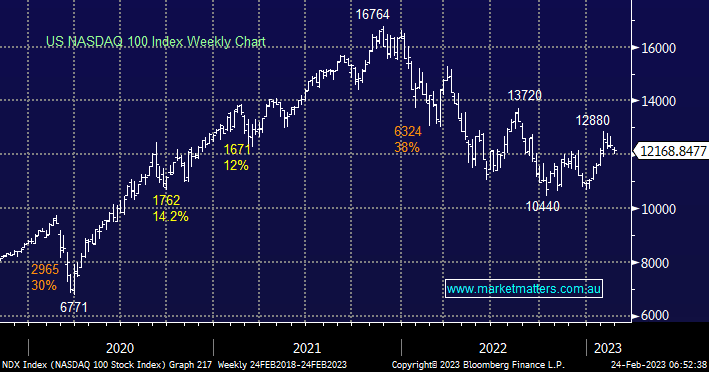

US stocks experienced another choppy session overnight as traders weighed up the prospects for an economic soft-landing as the Fed becomes increasingly hawkish. Retail investors are one group who have taken a bearish view with the bull-bear spread at its most pessimistic stance since the start of 2023. Subscribers should not expect an early end to the current uncertainty, as the balance between strong inflation, rising rates, and a resilient economy is tricky to navigate.

- Our preferred scenario remains the NASDAQ will eventually test over the 13,000 area, around ~8% away.

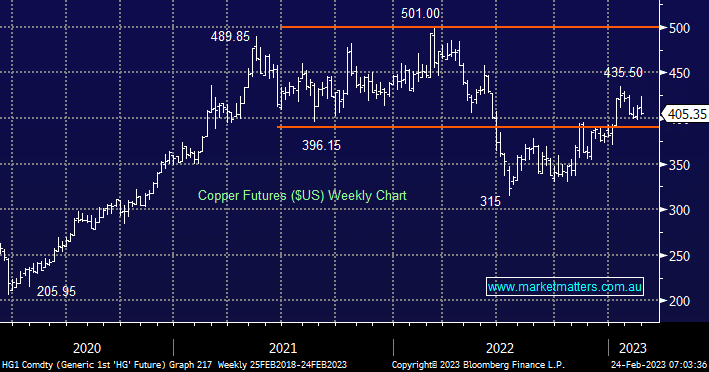

Stocks adopted an optimistic stance overnight but copper was less convinced falling over 3%, the industrial metal is not looking as resilient to rising yields as stocks.

- Copper is likely to continue with its uncertain swings until we see clarity return to the global economy.