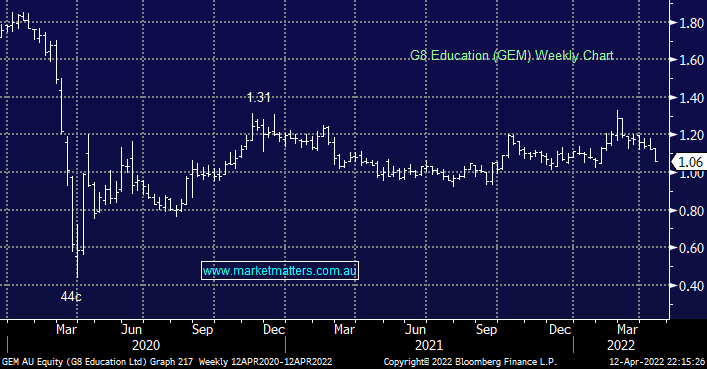

The Brisbane-based childcare operator provided a sobering 1Q22 trading update yesterday talking to continued disruption from Omicron and recent impacts from floods. Both of those aspects have an impact on occupancy levels which were 2.1% below last year in February, although recovered to be only 0.8% lower by March. Staffing issues caused some higher employment costs due to the use of agency staff however they did talk to improving trends right across these metrics by the end of March. They also outlined further cost reductions at head office ($15m-$18m annualised) and it seems at this point that lower occupancy at the start of the year is likely to be transitory given a strengthening pipeline of inquiry, tours, and conversions. All in all, we left the conference call yesterday feeling ‘okay’ about the year ahead for G8.

scroll

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains long GEM in our Income Portfolio

Add To Hit List

Related Q&A

What does MM think of RVR & GEM?

Does MM like GEM moving forward?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.