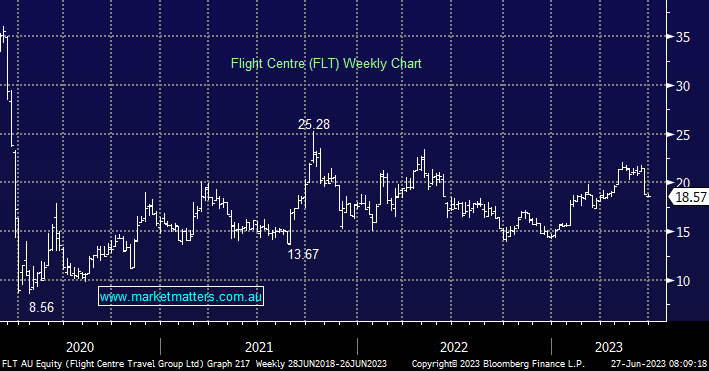

As touched on earlier travel and tourism is in the firing line if people aren’t prepared, or simply don’t have money to spend. Additionally, FLT has never fully recovered from being forced to raise ~$700mn through COVID which by definition significantly increased the number of shares on the register. The stock remains well under its 2021 high and we still see no reason to fight this underperformance although the “short position” has started to fall over the last year it’s still above 10% illustrating the lack of confidence towards the stock by traders.

- We can see FLT testing $15 if we are only at the start of consumers reining in their spending.