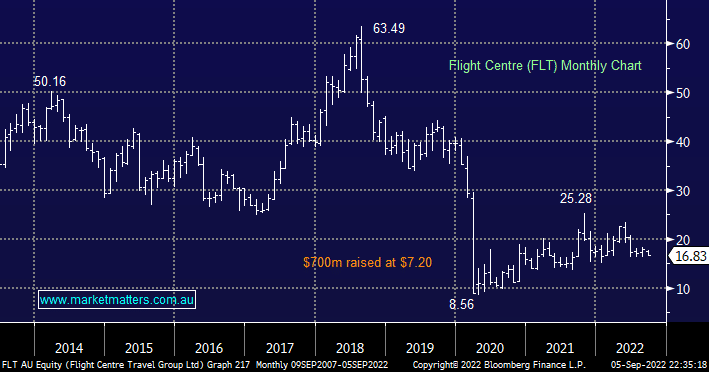

Last month saw FLT show $1bn of revenue for FY22 but they failed to give guidance for FY23 which we believe is reasonable considering the global uncertainties, but markets are never a fan of such a move. This is another travel company that’s struggled to recover from painful Covid disruptions and the trouble is to us is that it’s hard to decipher what normal earnings will look like from here. On a Est. P/E of 37x for 2023 it’s clearly expensive based on the market forecast for $90m of profit however if things do recover as current expectations imply, that number quickly jumps to more than $200m in FY24 making it palatable. Put simply, we think the stock is firmly in the too-hard basket.

- We see no reason to buy FLT ~$17 and lower prices wouldn’t surprise.