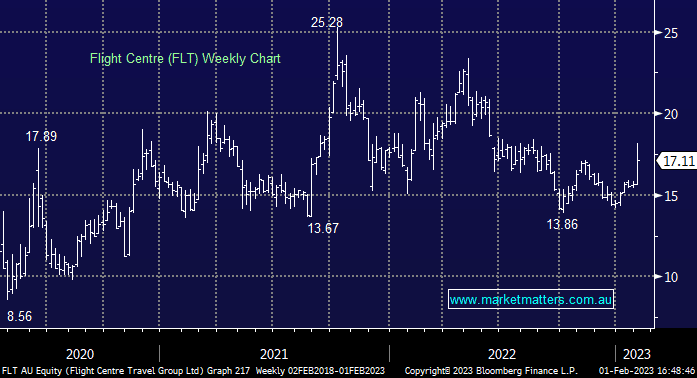

FLT +8.09%: rallied after completing a big $180m raise to help fund the acquisition of UK’s Scott Dunn. The company said the acquisition will be EPS accretive in the mid-teens while also giving them more leverage to the UK market as well as increased exposure to luxury holidays. Scott Dunn did ~$200m in transaction value and $51m in revenue last year with more than 70% of bookings coming from the UK. Flight Centre expects 1H revenue of $1b, EBITDA of $95m while guidance for the full year was $250-280m EBITDA, in line with expectations. The raise was completed at $14.60/sh with retail holders now eligible to bid into the Share Purchase Plan (SPP at the same price).

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral FLT

Add To Hit List

Related Q&A

Stock information – KOV please

Preference for CTD over FLT as a “Growth’ stock

CTD in Growth Portfolio versus FLT

What are your preferred travel Stocks: WEB / CTD / FLT?

Thoughts on Flight Centre (FLT) SPP please

What do you think about the FLT SPP

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.