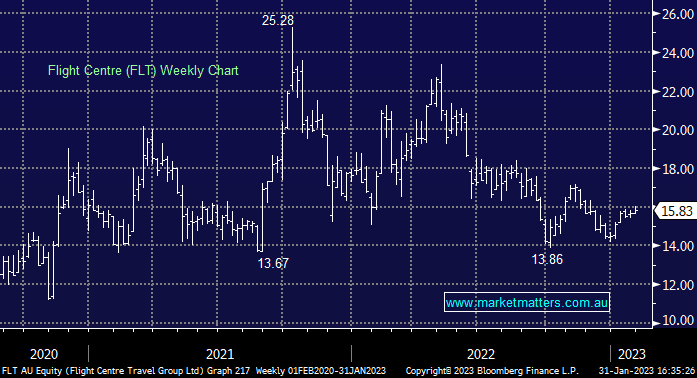

FLT Trading Halt: Raising $180m in fresh equity today at $14.60 to buy UK-based luxury tour operator Scott Dunn for $220m as they push further into the luxury market, this time focussing on a younger demographic with Scott Dunn’s customer base primarily in the 35-45 year age bracket. This is also a play on affluence with the average spend per booking of $39k meaning less price-conscious consumers which should in theory help FLT margins. While promoting the acquisition, they also increased earnings guidance, with 1H underlying earnings tipped to be $95m which is above prior guidance of $70-90m. A good update from FLT, strong trends in travel clearly helping their business however, the significant increase in shares on issue during COVID continues to hurt the recovery in share price.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM remains neutral FLT ~$16

Add To Hit List

Related Q&A

Stock information – KOV please

Preference for CTD over FLT as a “Growth’ stock

CTD in Growth Portfolio versus FLT

What are your preferred travel Stocks: WEB / CTD / FLT?

Thoughts on Flight Centre (FLT) SPP please

What do you think about the FLT SPP

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.