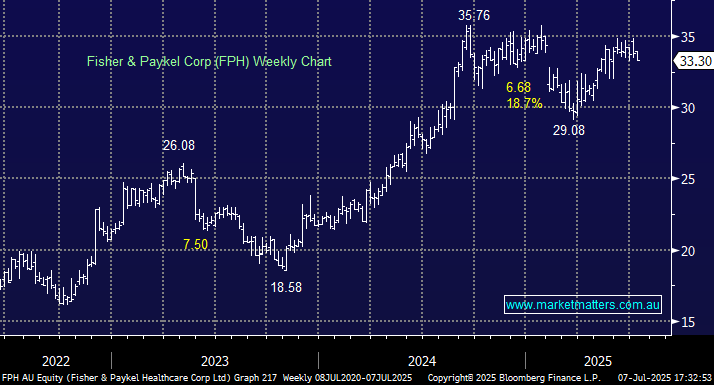

This NZ-based respiratory stock has been relatively stable in a volatile market. In May, the company reported well, although its conservative guidance disappointed the market; they aren’t on an island on this front. The stock is trading around fair value, and if we are correct and the sector and market push higher, it’s well placed to trade above $36. However, there’s no obvious catalyst at this stage to envisage an aggressive rally, making this a solid defensive stock, but not a compelling buy right now in our opinion.

- We are targeting new highs into 2026, but the risk/reward isn’t compelling.