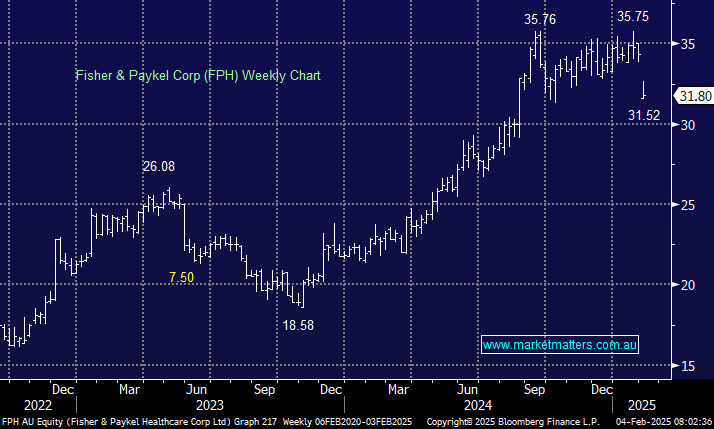

We touched on FPH in yesterdays Match Out Report, the drop yesterday of 7.4% was logical considering the companies exposure to Mexico but three things are sitting positively with us this morning:

- We liked how management at FPH immediately informed the market of their interpretation of the potential risk from Trumps tariffs in Mexico.

- We believe Mexico will come to the table, and largely placate Trump, which ultimately is good news for FPH although recent events might force them to turn the dial on NZ production.

- This is a quality healthcare company where shares have almost doubled since late 2023, a deeper Trump led pullback in our opinion will provide a good risk/reward opportunity.

Over the last 6-months, like much of the market, FPH has been trading on the rich side from a valuation perspective but further weakness courtesy of Trump could reverse this situation. The stock is likely to bounce this morning but this is one to consider moving forward.

- We like FPH in the $28-29 area, or ~10% lower which is not out of the question in today’s volatile environment.