- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

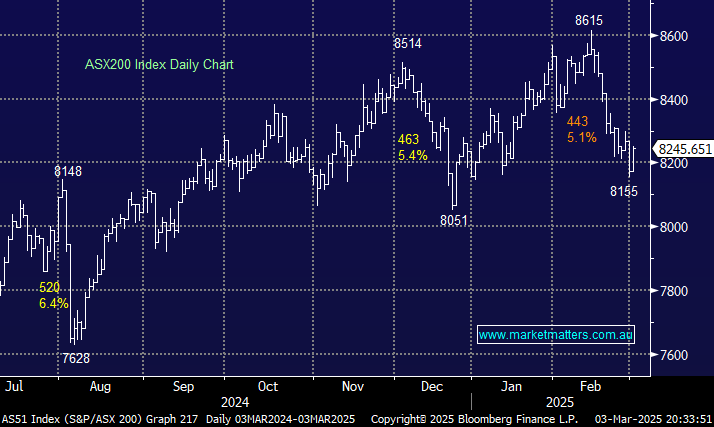

The ASX200 rallied +0.9% on Monday after Chinese Manufacturing Data came printed better than expected: The Caixin PMI came in at 50.8, well above the 50.4 consensus forecast, delivering its fastest expansion rate in three months. The impact across the ASX, both on the stock, sector and index level, was clear to see:

- Strong buying across the influential resources sector turned what was threatening to be a lacklustre day into a strong +0.9% gain, i.e. over 60% of the day’s move came after the PMI was released.

- Influential sectors like banks and healthcare names drifted lower after the PMI release, with some money likely switching to the struggling miners.

- The heavyweight resource stocks surged higher following the strong Chinese data. For example, market heavyweight BHP Group (BHP) reversed early losses to close up +1.4%, contributing with RIO ~20% of the index’s total gain.

Chinese investors face a key week, with officials meeting tomorrow to discuss economic stimulus. Manufacturing activity hitting a two-year high in February reinforces MM’s view that China’s economy is improving in a similar fashion to its stock market—more on this later. The private-sector manufacturing PMI, released on Saturday, has stayed above the 50 threshold that separates expansion from contraction since last October. However, interpreting data is tricky at the moment as the stronger external demand for Chinese manufactured goods could at least partly be due to U.S. importers continuing to front-run tariffs in anticipation of more to come – remember, he threatened 60% tariffs on China on his campaign trail.

- Trump announced that 25% tariffs will go into effect on Mexico and Canada starting today and that China will be charged an additional 10%, while China has vowed to retaliate.

Overseas markets were again mixed overnight. European bourses enjoyed a solid session, with the EURO STOXX 50 +1.4% and German Dax +2.6% catching our attention. However, it was a very different tale in the US, as stocks fell, extending February’s rout. A deadline on President Donald Trump’s tariff policies this week ratcheted up economic concerns. Soft economic data for the manufacturing and construction sectors provided further reason for concern about the state of the U.S. economy. With a “Trade War” looming, the current glass-half-empty attitude toward stocks saw selling gather momentum through the session, with the Dow falling 650 points and the S&P500 almost 2% – it was much worse at one stage in the last hour.

- The ASX200 is set to open down 0.9% following the tough Monday on Wall Street, although ongoing relative support looks likely from the resources sector.

This morning, we’ve revisited three major local AI-facing stocks after they found some love on Monday; our main focus was deciding if the time to increase our exposure to the thematic had arrived:

- An almost 9% plunge by Nvidia (NVDA US) overnight will likely weigh on sentiment across the AI space this morning.

The AI darling’s stock shed ~9%, marking an about-face from the nearly 4% gain it saw during Friday’s session. The move comes after The Wall Street Journal reported late Sunday that Chinese buyers are obtaining the company’s Blackwell chips via 3rd party companies in the region, illustrating how tough it will be for Trump & Co. to curtail US state-of-the-art technology arriving in China – impossible we would have thought.

- We have NVDA in our International Portfolios Hitlist but can see lower prices in the short term.