- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

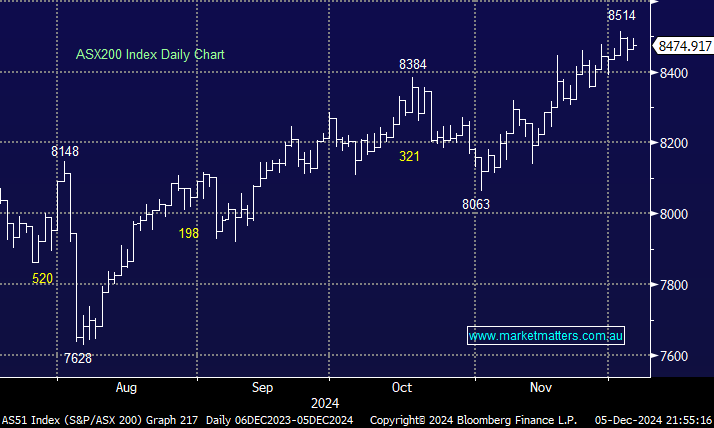

The ASX200 closed up +0.15% on Thursday in an ultimately lacklustre session, which promised more in the morning before surrendering two-thirds of its gains through the afternoon. Tech and consumer discretionary names advanced over 1% while real estate lagged, slipping -1.4%. On the commodities front, the story remains the same, and it’s starting to get a little bit monotonous as we head into Christmas, less than three weeks away:

Gold stocks rallied: Genesis Minerals (GMD) +9.1%, Ramelius Resources (RMS) +8.5%, West African Resources (WAF) +8%, Perseus Mining (PRU) +6.5%, and Regis Resources (RRL) +5.5%.

Lithium/ESG stocks struggled: Liontown Resources (LTR) -6.5%, Pilbara (PLS) -3.8%, Iluka Resources (ILU) -2.8%, Mineral Resources (MIN) -1.9%, and IGO Ltd (IGO) -1.6%.

The “pop” higher by gold names was particularly impressive, with the precious metal basically treading water. Conversely, lithium stocks remain out of favour even after UBS called the low this week for Spodumene (Lithium) prices. As we approach the end of 2024, fund managers are unlikely to sell down their winners, weighing on performance; hence, we could see more of the “strong getting stronger” and vice versa before all start singing Auld Lang Syne. Especially as, at this stage, the market remains hungry for growth with an apparent indifference to valuation.

Overseas markets were again mixed, European bourses were solid, led by the EURO STOXX 50, which closed up +0.7%, and the German Dax, +0.6%, a good result considering the political turmoil and uncertainty unfolding in France. However, US indices drifted lower, with the S&P500 slipping 0.2%. On Thursday, the Dow pulled back below its record closing level above 45,000 as enthusiasm around Bitcoin’s move above $100,000 failed to rally stock market bulls. An excellent illustration of euphoria in pockets of today’s market came after Shares of GameStop (GME US) jumped 10% to a session high after meme stock personality “Roaring Kitty” posted a cryptic image of a computer on X. The post garnered nearly 20,000 likes in 20 minutes! – If you haven’t seen the movie “Dumb Money”, we strongly recommend it for avid investors.

- The SPI Futures are calling the ASX200 to open down 0.2% following the mixed performances across global bourses.

Australia’s largest gold miner, Northern Star (NST), agreed to buy smaller rival De Grey Mining (DEG) for $5 billion this week. The gold price has busted out to new highs this year, with the Futures hitting $A4,300 last month after kicking off the year around $A3,200, a more than 30% gain. Central banks’ demand for physical gold, led by Russia and China, as they seek to diversify reserves away from the greenback has pushed up the metal and related stocks. Their appetite could be the start of a structural change, but whatever unfolds in the years ahead, the trend is very bullish for now.

Today, we’ve revisited this illustrious space with a special emphasis on our initial targets for some prominent names—the question we get asked so often.

- Ramelius Resources (RMS) was identified as SPR’s mystery raider in July. It now holds 19.9% of the gold hopeful after topping up its holding in this week’s placement, funding the purchase from cash reserves.

- MM is bullish SPR, initially targeting the $1.80-$2 area, with corporate action a clear possibility.