- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX200 closed up +0.3% on Monday, but it was a somewhat lacklustre session, with the index surrendering ~65% of its early morning gains. With 40% of the main board closing lower along with 3 of the Big 4 Banks, it was always going to be tough for the local index to make meaningful headway, although it did register another all-time high early in the morning. With the high-flying banks and tech stocks tiring, it will be hard for the market to breach our 8500-8600 target into Christmas unless the resources come back into play.

- We continue to give the bull market the benefit of the doubt as we enter December, but the “3-steps forward, 2-back” rhythm appears to be the go for now.

Hedge Fund manager Scott Bessent’s selection as the next U.S. Treasury Secretary came as a relief to Wall Street, who expect the Treasury Secretary to advocate a gradual layering of tariffs. Treasuries rallied on the news on bets he would soften Trump’s policies, reducing the likely tailwind for inflation. Although Trump is slowly fading from the news as he waits to take over the Presidency from Joe Biden on January 20th, in the meantime, Biden appears committed to supporting Ukraine against Russia, arguably making it harder for Trump to negotiate peace in 2025.

- Local focus will switch to Wednesday’s monthly CPI, which is forecast to inch up 0.2% to an annual rate of 2.3% in October—no rate cuts are likely in a hurry.

- The RBNZ is widely expected to deliver an outsized 0.5% rate cut on Wednesday as Australians continue to miss out on the “rate cut party”.

Global stocks were mixed overnight, with the market generally welcoming Bessent, who runs the macro hedge fund Key Square Group. Bessent has called for a gradual approach to implementing trade restrictions and has appeared open to negotiating the exact size of tariffs championed by the president-elect. The Russell 2000 (small caps) popped over ~1.5% to fresh 2024 highs, while the tech-based NASDAQ was little changed as Nvidia (NVDA US), Tesla (TSLA US) and Netflix (NFLX US) all fell over 3.5%. European bourses were firm, with the EURO STOXX 50 advancing +0.2% and the FTSE 100 +0.4%.

- The ASX200 is set to open up +0.2% with gold and energy names likely to lag – BHP Group (BHP) was ~15c higher in the US.

As the clock ticks for Anglo-American (AAL LN) with only a few days before BHP can launch a fresh takeover after its $75bn bid was rebuffed in May, the AAL board has acted to improve the balance sheet, selling Queensland coal mines to Peabody (BTU US) and Indonesia’s BUMA for ~$5.8bn. The deal is subject to a few conditions but delivers a couple of messages to MM:

- This is an interesting move by Anglo having sold their Queensland’s Lake Vermont and Jellinbah coal mines recently for $1.6bn while their nickel division is also up for sale.

- On one hand, these sales shore up their balance sheet and is a step towards their strategic plan put to shareholders when they rejected BHP’s advances.

- However, clearly the business is being transformed into a copper, iron ore, and crop nutrient operation, a very similar mix to BHP themselves, perhaps making AAL more appealing to their suitor.

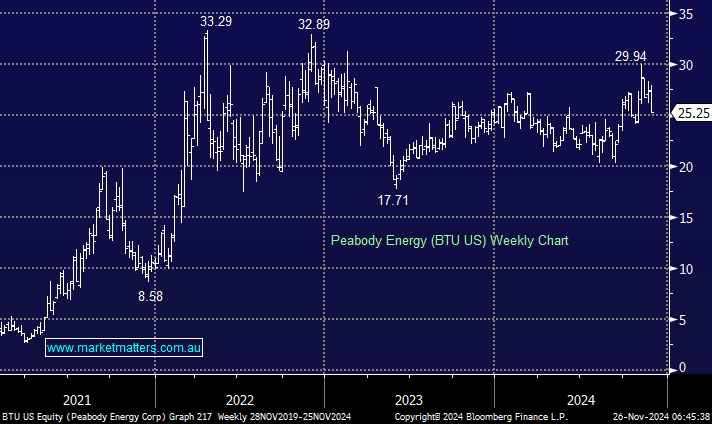

On the acquisition side, Peabody is doing what all coal companies need to – getting big or getting out. This is a theme that will likely continue, with coking coal assets (used in steel making) in demand more than thermal coal assets (used in power generation).

The sale breakdown gives Peabody (BTU US) control of four Queensland coking coal mines: Grosvenor, Moranbah North, Aquila, and Capcoal. The deal will triple Peabody’s coking coal production, which is used for steelmaking rather than power generation.

- We like Peabody and are ultimately looking for new recent highs above $US35. MM is long BTU in our International Companies Portfolio.

This morning with the appetite for Australian coal mines strong, we’ve quickly updated our view on the three major ASX coal stocks.