What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

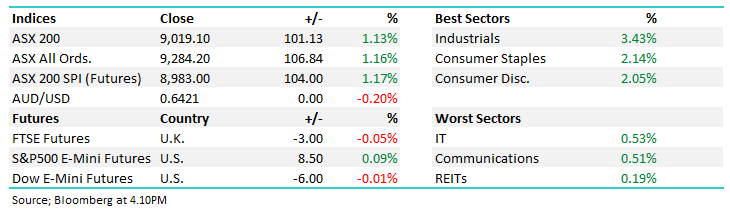

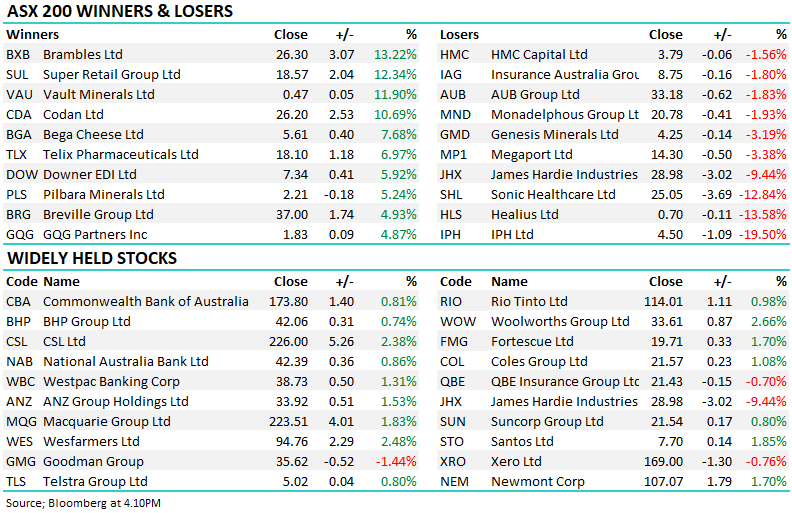

Thursday saw the ASX200 advance +0.8% as M&A returned to the local market after a brief absence, and with a strong, broad market sending 8 of the main 11 sectors higher, it’s hard to argue that the bull market isn’t still in control with the all-time high only 1.3% away. The combination of reporting season and the bid for Altium saw increased volatility, with 7.5% of the main board moving by over 5%, although outside of a surging tech sector, moves were primarily driven by earnings beats/misses.

- Fund managers appeared to decide that the ALU bid would prove successful, sending money scrambling for a home elsewhere in the ASX Tech Sector.

The Australian jobless rate rose above 4% for the first time in 2-years, which relieved the pressure on bond yields following the higher-than-expected US CPI earlier in the week – it feels like an age since we switched on our screens to see the Dow down over 500 points, not just 48-hours. The interest rate-sensitive names were among the better-performing names on Thursday, with Real Estate & Consumer Discretionary Sectors rounding out the Top 3 on the day, albeit very much in the shadow of tech – sounds like the US!

The technical picture offers hope for both bulls and bears, with pessimists citing the drive back under the January swing high as a concern, whereas the optimists would counter with how easily the markets bounced from the 7500 area. At MM, we don’t like to argue with the tape; for now, the trend is still up, and the most exciting action is to be found on the stock & sector levels.

- This morning, the SPI Futures are calling the ASX200 to open up ~1% as a strong performance by the Resources Sector in the US looks set to push the ASX200 back towards 7700.

This morning, we briefly revisited the ASX Tech Sector; at MM, we’ve been calling the growth sector to underperform in 2024, following a stellar 18 months. After breaking out to new 2-year highs following the $9bn takeover bid for Altium (ALU), we have taken a deep breath and adopted a neutral to bullish stance, hopefully not with the same timing used to take profit in ALU! Fund managers will find it increasingly difficult to find high-quality growth stories on the ASX, likely leading to higher valuations across the sector, especially in the most highly rated stocks.

- Fortunately, our Active Growth Portfolio didn’t abandon the growth sector, we still hold 5% in Xero.

This morning, we’ve briefly revisited three prominent names in the local Tech Sector, all of which enjoyed a strong bid tone following the ALU news as the sector surged +6.8%.