What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

It was very encouraging to hear that Israel and Hamas have agreed to a 4-day ceasefire and the release of 50 hostages held in Gaza in exchange for 150 Palestinian women and children being freed from Israeli jails; hopefully, this is the start of an improvement in the region. The reaction across financial markets, or lack thereof, illustrated perfectly that despite the huge humanitarian issues, markets are betting this will remain contained:

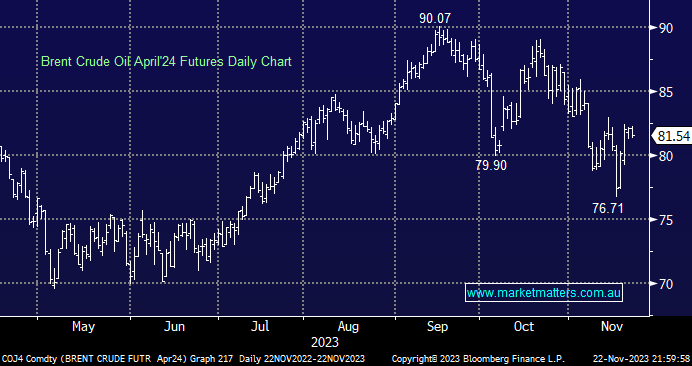

- Brent crude oil slipped less than 1%, which hardly registers on the volatility scale compared to the gyrations of the last 6 weeks.

- Following the news, gold edged a few dollars higher, again testing the psychological $US2,000 level basis cash before slipping as bond yields rose.

For the last few months, MM has preferred gold over oil into Christmas and beyond; this outlook hasn’t wavered, although having moved significantly in our direction, some reversion wouldn’t surprise. Moves on the stock level have been pronounced since September, but we wouldn’t be fighting either trend, i.e. Woodside (WDS) -20% compared to Northern Star (NST) +14%.

- We continue to prefer gold over oil into/through 2024.

The ASX200 experienced its fourth consecutive quiet session with a range on Wednesday of just 29-points, or 0.4%. The index ultimately only closed down a few points, which is a testament to the influence of the banks & miners – both advanced largely offsetting over 60% of the main board that closed lower. It was a quiet day, with stocks appearing cautious to see how the US would react to Nvidia’s (NVDA US) result, which from a headline perspective was phenomenal but of course, a lot of optimism was already baked into this A1 cake!

- This morning, the SPI Futures are calling the ASX200 to open down -0.20% after an increase in bond yields sent the Resources Sector lower, e.g. BHP Group (BHP) closed down ~30c in the US.

This morning, we briefly looked at three stocks that caught our attention in what was a quiet Wednesday across the ASX: