What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

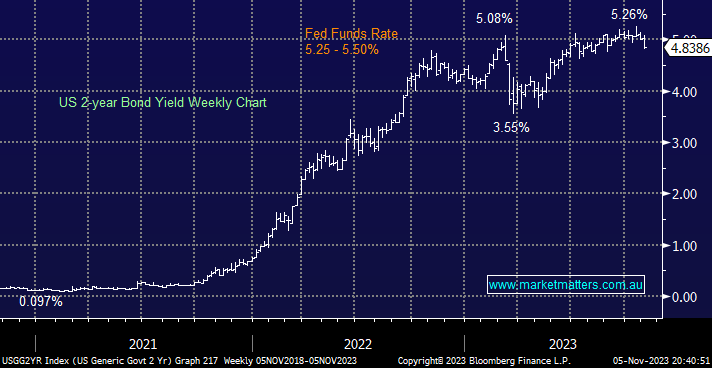

Last week saw equities rally strongly encouraged by Jerome Powell et al., the Fed left interest rates unchanged and delivered arguably their least hawkish speech of 2023. This was the second consecutive time the Fed didn’t raise the target federal funds rate from 5.25%-5.5%, although it’s still the highest level in more than 22 years. However, what ignited stocks was Jerome Powell’s balanced speech, which included the phrase that the run-up in long-term yields has reduced the need to hike again. Powell again stressed that the Fed remained “strongly committed” to reducing inflation, but the recent economic data suggest pressures are falling. Last week saw jobless claims rise for the 6th straight week, suggesting people who lose their jobs are finding it harder to rejoin the workforce as we approach Christmas.

The RBA step up to the plate tomorrow with their latest rate decision. On balance, we believe they shouldn’t and won’t hike as weakness creeps into the local economy, Q1 and Q2 of 2024 could be a testing time for many people in Australia. However, the futures markets are leaning towards a hike after four consecutive meetings where rates were left steady, although consensus has been bouncing around from economic print to economic print, both at home and overseas. The US employment numbers on Friday were weaker than expected, boosting hopes the Fed has finished hiking rates while the UK is already flirting with a recession, it surely isn’t the time to hike for the RBA.

- MM is looking for Michele Bullock to leave the RBA Cash Rate at 4.1% on Cup Day, but it’s a close call, and we are against ‘consensus’ on this view– equities are likely to struggle for a few days if they hike.

- No change for US shorter dated bonds, we are looking for the US 2s to test 4% through 2024/5, with current weakness back under 5%, an encouraging move.

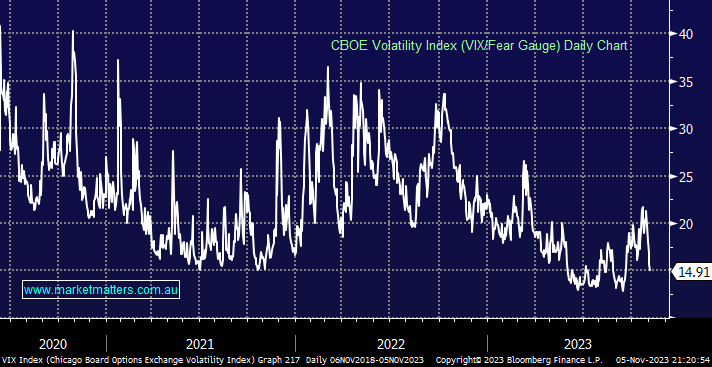

Over the last fortnight, the VIX has plunged from 23% to sub-15 %, a whopping -35 % decline, illustrating how the Fed calmed investors. It’s a touch surprising, but after such a tough September & October, the path of least resistance for the “Fear Gauge” is still down, and as we’ve witnessed throughout 2023, don’t fight the tape!

- We can see the VIX making fresh lows for 2023 into Christmas, but we wouldn’t be a seller from a risk/reward perspective. i.e. selling volatility into these levels does not make sense.