What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

Australian bond yields kicked higher on Tuesday after the RBA minutes revealed that further rate hikes remain a real possibility, the rate-sensitive 3-years closed up 13bps at 4.08%, while the 10-years advanced +9bps to 4.55%.

- The RBA announced they had considered hiking earlier in the month but kept rates at 4.1% because there “wasn’t enough new information”.

- The central bank also warned that it had a “low tolerance” to not returning inflation back to its 2-3% target by late 2025.

In other words, Michele Bullock et al. have given themselves around 2 years to rein back inflation from the recent 6% posted for the June quarter, things are heading in the right direction after peaking at 7.8% in the December 2022 quarter. However, with the oil price trading around $US90/barrel, it’s going to be a big ask to more than halve inflation in the required timeframe unless we see economic contraction. There were two glimmers of hope that caught our attention:

- The board members acknowledged that the Australian labour market had reached a “turning point”.

- “The tightening of monetary policy since May 2022 was still permeating through the economy, and it would take some time for the full effects of this to be observed in the data”.

In our opinion, this was a simple message that we have heard a number of times previously through 2023, i.e. the RBA is data dependent and investors/traders shouldn’t get too excited in anticipating a refreshing dovish message until the data is crystal clear. Next stop, Melbourne Cup Day, let’s hope they don’t get excited and exert increased pressure on many Australian households just before Christmas.

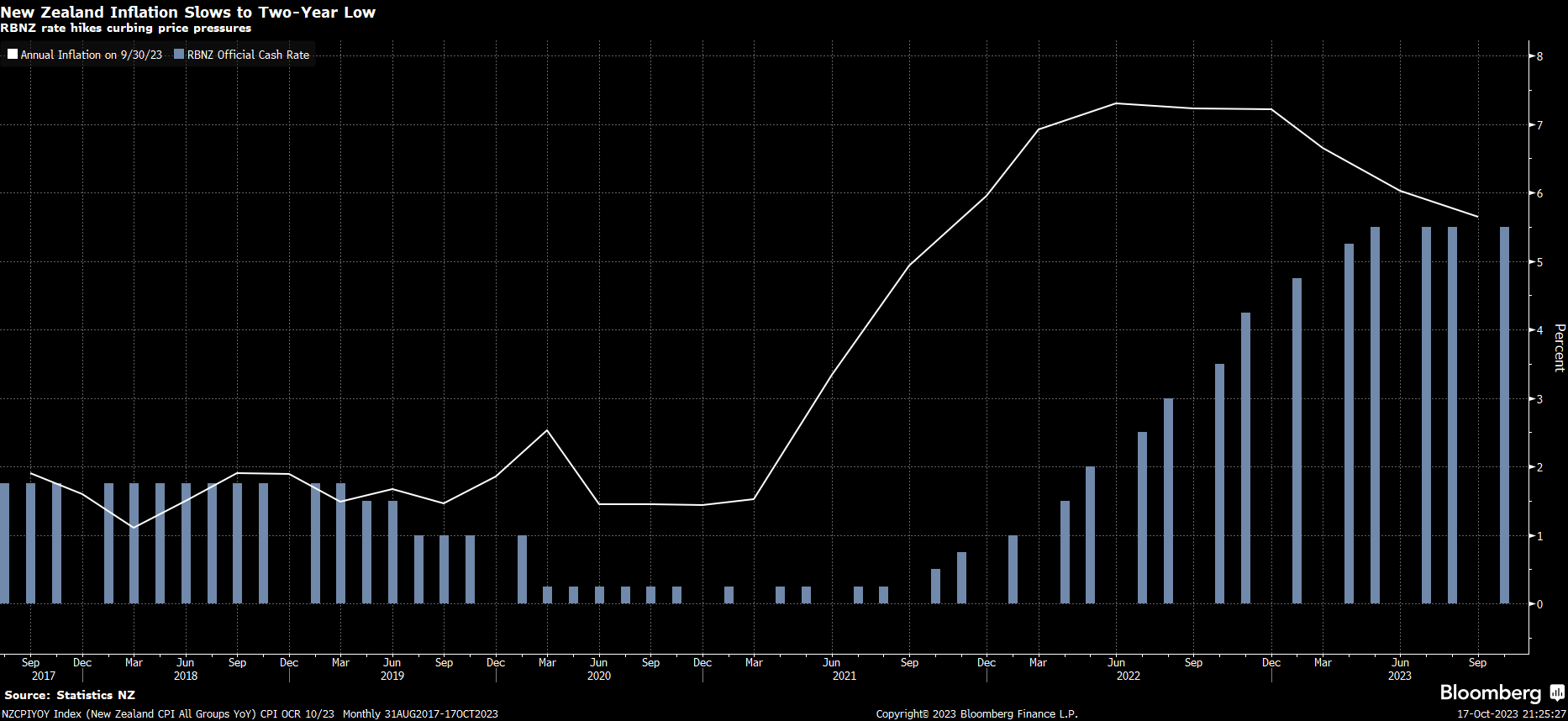

Yesterday, New Zealand inflation slowed more than economists expected in the third quarter as the central bank’s aggressive interest-rate hikes curbed household spending. The annual inflation rate fell to 5.6%, a two-year low, from 6% in the second quarter, economists expected 5.9%, while the Reserve Bank had forecast 6%. Also, Consumer prices advanced 1.8% from three months earlier, less than the 1.9% median estimate. Earlier this month, the RBNZ held its Official Cash Rate at 5.5% while adding policy may need to be restrictive for a sustained period of time to get inflation back into its 1-3% target range by the second half of 2024 – at a glance a more demanding task than the one set for the RBA.

- Investors/traders reduced bets on another rate increase in NZ on the same Tuesday that they adopted a more hawkish approach to the RBA.

Tuesday was a solid day for the local index, but the hawkish RBA Minutes reined in strong early gains to leave the index up +0.4% at 4.10pm. The tech sector was best on the ground, closing up +1.3% with solid gains by the likes of Megaport (MP1) +3.7%, Xero (XRO) +2%, and WiseTech (WTC) +1%. However, what caught our attention was the lack of top performers in the market winners’ enclosure – as we alluded to in yesterday’s “The Match Out Report,” perhaps bargain hunting is about to finally unfold, although we have seen false dawns of this through 2023. Conversely, we have started to see a few stocks struggle after making fresh highs for the year, which again smells like value switching – more on this later in the Active Growth Portfolio section.

The Middle East conflict is simmering away and, at this stage, largely being ignored by markets as nations strive to avoid contagion and huge civilian casualties. The S&P500 slipped overnight as sentiment was soured by the double whammy of weakness in Nvidia (NVDA US) and a jump in Treasury yields following a stronger-than-expected retail sales number – the 2-year yields hit a 17-year high after retail sales came in at +0.6%, significantly above the expected gain of +0.1%.

- This morning, the SPI Futures are pointing to a firm opening up ~+0.3% helped by a 30c advance by BHP Group (BHP) in the US.