What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

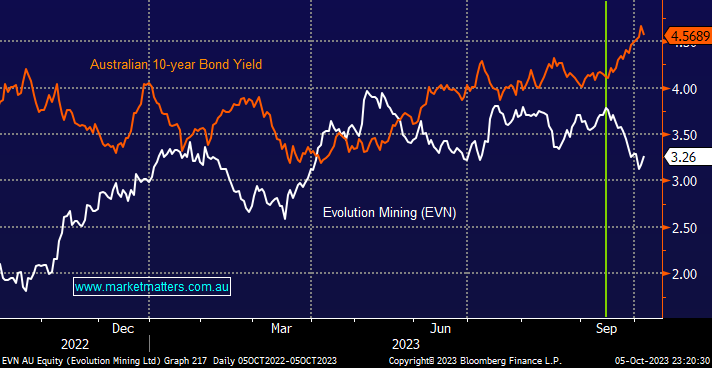

Gold stocks have endured a tough few weeks as global long-dated bond yields broke out to multi-year highs, e.g. Evolution Mining has fallen 20% since mid-September while Australian 10-year bond yields surged from 4.09% to 4.67% – it’s an easy correlation to understand as precious metals pay no yield hence when bonds fall in price (yields higher) they become relatively more attractive. However, as we saw yesterday when yields retreat, the gold sector can snap back with a vengeance, although EVN needs to add to its +2.8% before we will start to enjoy our Flagship Growth Portfolio’s overweight exposure to the sector.

At this stage, we would only go as far as saying that bond yields are looking for a top, but a spike back toward 4.7% by the local 10-years is likely to provide an excellent risk/reward buying opportunity in EVN et al. – we only hold a 3% position in gold/copper producer EVN which we are considering tweaking to 4% over the coming weeks if/when we see another test down towards $3.

- We believe the risk/reward towards the gold stocks now favours the bulls.

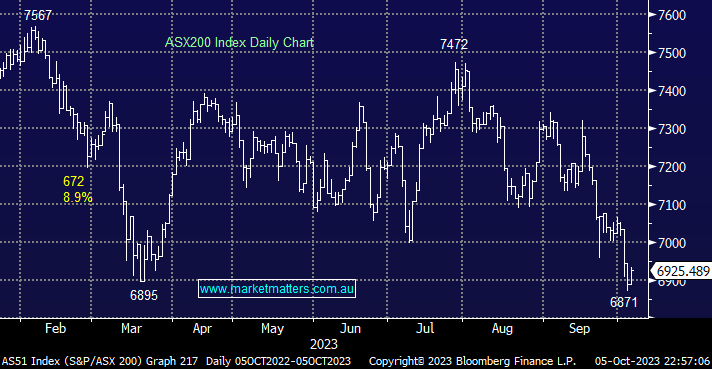

The local market finally saw some buying on Thursday, closing up +0.5%, with almost 75% of the main board in positive territory. The gold stocks stood out within the winner’s enclosure as bond yields retreated, with Northern Star (NST) +4.7%, the best performer name on the ASX200 following a broker upgrade from JP Morgan. The local tech stocks finally embraced a positive lead from Wall Street, closing up +1.7%, although Real Estate took line honours, ending the day +2.1% higher. The Energy Sector arguably delivered one of the best performances, which managed to restrict losses to -0.9% even after crude oil plunged over -5%.

- The SPI Futures are pointing to a flat opening this morning following a relatively quiet session on Wall Street, e.g. The Dow closed down just -0.03%, with US Non-Farm Payrolls (Employment) due out tonight which will have a key influence on bonds and thus equities, consensus estimates are for +170k jobs and unemployment to tick down to 3.7% (from 3.8%).