What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

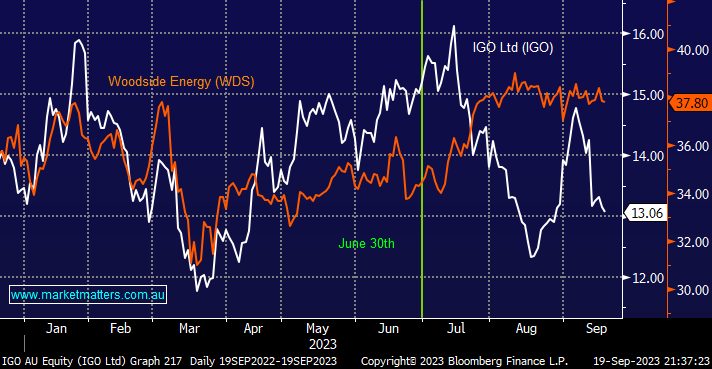

Investing is rarely easy and obvious, and that’s proved to be the case since June 30th, with ESG/lithium stocks struggling while “dirty energy” names shine even as the globe embraces EVs and a clean world into the future:

Winners: New Hope (NHC) +30%, Woodside Energy (WDS) +9.8% and Santos (STO) +4.4%.

Losers: Allkem (AKE) -22.4%, IGO Ltd (IGO) -14%, and Pilbara Minerals (PLS) -13.5%.

The performance from the major coal stocks has been mixed of late, with New Hope Corp (NHC) significantly outperforming Whitehaven (WHC), whose share price has been punished as they consider buying two major coal mines that are jointly owned by BHP Group (BHP) and Japan’s Mitsubishi – more on NHC later in today’s report. At this stage, we don’t know if WHC will prove successful with their bids, but for now, the company has put their buyback on hold, i.e., it makes sense if you are about to spend $4.5-5 billion! Assuming they don’t overpay for the assets, we like the move, especially after coal has fallen by over 50% since mid-2022.

Woodside Energy (WDS) and IGO Ltd (IGO) recently paid healthy dividends, i.e. $1.24 and $60c respectively, with both fully franked. However, outside of their dividend, the two stocks have recently travelled a very different path, with IGO following the lithium sector lower even after a strong earnings report last month. We’ve alluded to WDS being tired around $38 in recent reports as it struggles to embrace gains by energy prices and its global peers. This has led us to consider alternatives for our capital in the Flagship Growth Portfolio.

- We are considering a switch from WDS with IGO as an option if we feel brave towards the volatile lithium space – we already hold Mineral Resources (MIN).

Tuesday was another tough day at the office for Australian equities, with a +0.2% gain by the Energy Sector the only shining light as the index ended down 0.5%. It came as no surprise to MM that buyers remained on the sidelines before Wednesday night’s FOMC meeting, i.e. will the Fed hike, probably not, but the bias implied through the Dot Plot is what’s likely to determine how the market moves. With the S&P500 within striking distance of its 2023 high and the US 10-year yielding 4.3%, we believe there is a diminishing amount of room for a hawkish Fed.

- This morning, the SPI Futures are pointing to a -0.2% dip by local stocks, a similar decline to US indices in quiet overnight.