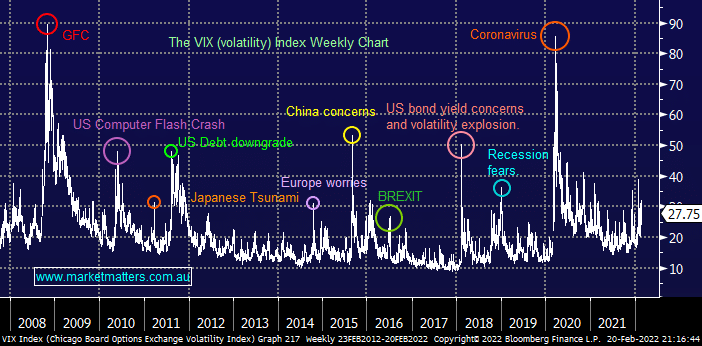

After only 7-weeks 2022 has certainly felt like a volatile year but a quick glance at the Volatility / Fear Index would question this interpretation, we may have experienced plenty of action above the average of the last 10-15 years but we haven’t witnessed any sheer panic as we did when markets fell in 2018 around bond yield concerns or like the chaos after US Debt Downgrade in 2011. We have 2 theories why the escalation in volatility has been relatively orderly:

- Financial markets, just like MM, always believed interest rates were set to rise in 2022/23 hence they haven’t been as surprised by the recent rally in bond yields as they were in 2018.

- Every time post the GFC that investors have witnessed a pronounced spike in volatility it’s proven to be a great buying opportunity in stocks hence investors look to fade such moves.

MM cautions against complacency believing that when we do see a bear market that takes indices down say 20-30%, as opposed the relatively common 10-15% its more likely a steady erosion of wealth over a few years as opposed to a sudden news driven event that’s in the rear view mirror almost before we’ve digested it e.g. even though we’re still seeing 1000’s of cases of the Omicron variant on a daily basis as far as stocks have been concerned COVID was steadily losing its market influence within a few months of the initial outbreak.

- If we see markets plunge lower in the coming weeks around conflict in the Ukraine its likely to prove at least a short-term buying opportunity.

- Conversely if we continue to see growth companies fall short on earnings & / or outlook we anticipate ongoing deep rerating’s of high valuation companies.

Overall MM believes investors are going to see ongoing volatility through 2022/23, especially on the stock / sector level, it looks set to be a tougher period for investors who believe that the investment landscape will be similar to post the GFC and COVID i.e. the current rerating of growth stocks feels like just the 1st chapter in an exciting but challenging evolving investment playing field.