The ASX200 along with most global indices has taken a dive this month, its amazing how fundamentals have a habit of delivering events which coincide with the dominant seasonal trends i.e. September is regarded by many as the worst month to invest in equities. The fascinating impact of human psychology as it swings between “Fear & Greed” is evident when a market falls as expected only for investors to then find themselves questioning their fortitude to stand up and buy when things feel bad – an action which is usually but not always the correct course of action. In today’s title please excuse the indulgence to a classic Clint Eastwood movie!

At times like this we feel it’s imperative to stand back and remember our bigger picture view towards equities, along with the dominant themes driving stocks:

- MM is still bullish stocks but we believe the bull market is maturing fairly fast hence our current mantra “buy the dip and fade the pop”.

- We still expect inflation and bond yields to increase moving into 2022 which should benefit the resources & banks i.e. the named value stocks.

- Staying long has paid dividends since COVID raised its head but we believe taking some money from the table will become more important into 2022, and beyond.

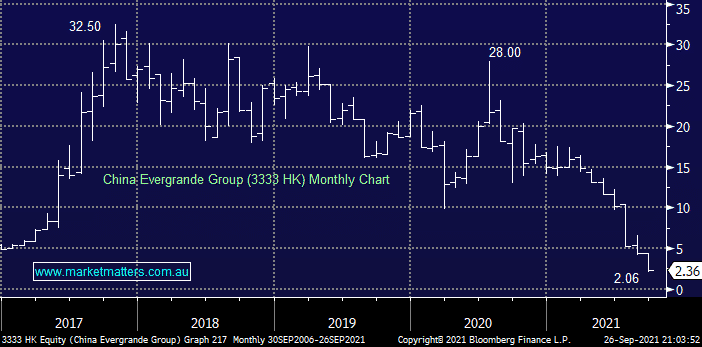

As we all know China Evergrande (3333 HK) shares have been collapsing through 2021, the plunge by the property developer has taken more than 90% off its value in just 14-months, 3 things have become blatantly apparent to MM:

- Beijing is very happy teaching property developer’s & investors / speculators a very tough lesson around debt levels & leverage.

- Chinese authorities are unlikely to let property prices collapse leading to major financial contagion across China and the world.

- However there is unlikely to be a “V-shaped recovery” in property activity in China which provides a negative influence for iron ore and its related stocks.