The ASX200 advanced another 1% last week, closing above the psychological 8600 level for the first time. The healthcare, real estate, and materials sectors all closed up around 3%, while the financial sector was the weakest over the five days, closing down 0.7%. For the market to extend the recent gains, it will need to shrug off high valuations and lack of earnings growth, although, as we saw last week, the resources stocks can do some of the heavy lifting after experiencing a tough 18 months.

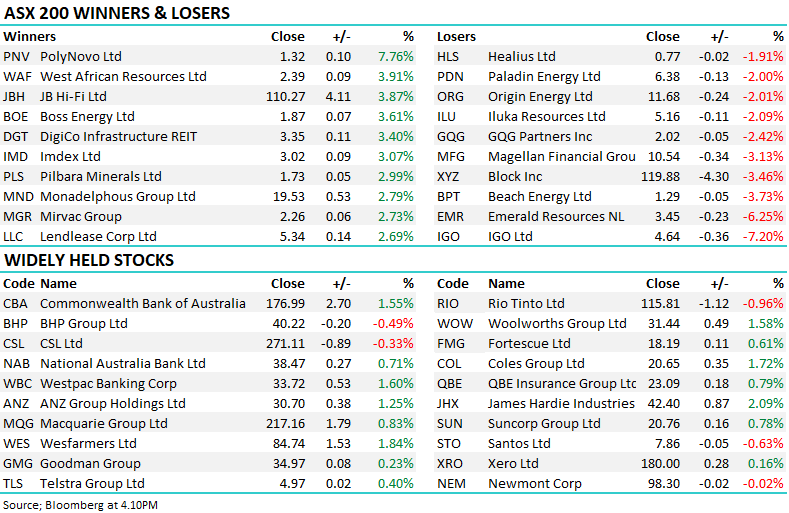

By the close on Friday, the winners and losers enclosure showed some major stock/sector moves with the fund managers, lithium names, and travel stocks all enjoying a strong bid, while the losers were more of an eclectic, news-driven bunch, plus some ongoing weakness in gold names. Performance rotation was again evident, with ANZ the strongest bank while CBA was the weakest:

Winners: Mineral Resources (MIN) +17.6%, AMP Ltd (AMP) +12.2%, Magellan (MFG) +11.7%, Pilbara (PLS) +10.2%, James Hardie (JHX) +9.9%, IDP Education (IEL) +9.8%, Pro Medicus (PME) -9.7%, NIB (NHF) +9.4%, Corporate Travel (CTD) +9.2%, Whitehaven Coal (WHC) +7.6%, and ANZ Group (ANZ) +3.8%.

Losers: Helia Group (HLI) -17.1%, HMC Capital (HMC) -13.6%, Boss Energy (BOE) -11.5%, Domino’s Pizza (DMP) -7.1%, Lynas (LYC) -6.9%, Gen Dev. (GDG) -5.4%, Megaport (MP1) -4.9%, Ramelius (RMS) -4.8%, Pexa Group (PXA) -4.4%, Spartan Resources (SPR) -4.1%, and Commonwealth Bank (CBA) -4%.

On the economic and geopolitical front, the markets’ focus has moved back towards tariffs after deciding Fed rate cuts were unlikely this month, after signs the US economy remains resilient:

- Locally, on Wednesday, we saw weak retail sales and building approvals data weigh in favour of RBA rate cuts this side of Christmas, including a likely 0.25% move this coming week.

- Midweek saw President Trump announce he had reached a trade deal with Vietnam, lifting stocks. However, into the weekend, he was threatening to send letters to several countries informing them of tariffs up to 70%—wave two, perhaps.

- On Thursday night, the US S&P 500 and NASDAQ hit fresh highs after a better-than-expected jobs report fuelled optimism that the US economy remains firm; US non-farm payrolls rose by 147,000 in June, exceeding estimates of 106,000.

- On July 4, President Trump signed the tax and spending bill that permanently extends the 2017 tax cuts, which are projected to increase the national debt by $3.4 trillion over the next decade.

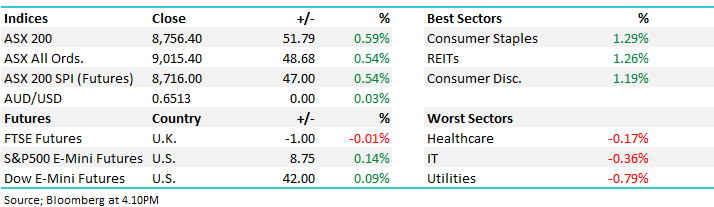

Overseas markets ended the week on the back foot, with US futures slipping on tariff concerns, although Wall Street was closed for Independence Day. The German DAX dropped 0.6% in Europe, and the French CAC 0.8%, while the UK closed flat.

- The SPI Futures are calling the ASX200 to open flat, shrugging off a weak session by the S&P 500 futures and a 1% drop by the EURO STOXX 50.