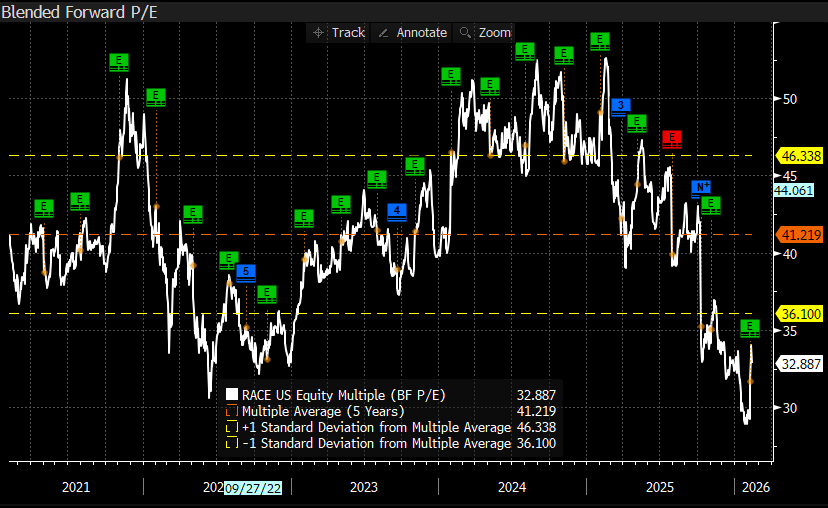

We have had Ferrari on our hitlist for the International Equities Portfolio for some time, and after a recent pullback, we are now contemplating adding RACE US to the portfolio. Ferrari is now trading on FY26 Est earnings of 33x, down from over 50x in 2025, and while the valuation still looks full relative to the broader market (and competitors), we think it can justify its premium through exceptional pricing power, strong order-book visibility and a margin profile that most global luxury peers can only envy.

Ferrari’s order book stretches into late-2027, which is rare visibility for any consumer-facing business, and particularly attractive in this type of environment where certainty is becoming a scarce commodity. That backlog supports pricing power and reduces the risk of sudden volume shocks. Because of these dynamics, their margins are best-in-class. Recent results and guidance point to stronger-than-feared 2026 profitability, with management forecasting higher core earnings and healthy operating margin assumptions. On consensus earnings forecasts, RACE US is expected to grow profits at ~8% per annum for the next 3-years, with a high level of certainty.

This is predicated on Ferrari’s ability to manage their order book, which has been a core strength for many decades. While they did flag that FY26 is going to be second half weighted, with FX headwinds and model transitions likely to cap upside in the first half of the year, these dynamics are now well known by the market (and priced in), and we think recent weakness (bar an uptick in the last few weeks) should be viewed as an opportunity for this high quality, durable global brand.

Their ability to steadily lift margins, supported by product mix, personalisation and disciplined cost control, reinforces MM’s confidence in the medium-term earnings trajectory. With strong demand visibility and multiple product catalysts ahead, including their first EV (Luce), we think Ferrari will remain one of the highest-quality compounders in global equities.

- While we continue to assess entry point, we remain drawn to their consistency in earnings, scarcity value, and resilience in a market that is very concerned about the broader impact of AI.