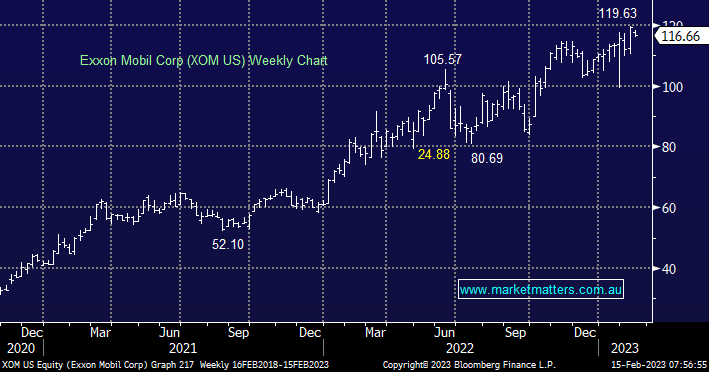

Exxon Mobil is the 2nd biggest energy company in the world (behind Saudi Aramco) with a market capitalisation of $US485bn, roughly 10x the size of ASX-listed Woodside Energy (WDS). In the December quarter, they generated revenue of $US95bn producing a net profit of $US14bn, about double the amount CBA will do in FY23 overall. These earnings are simply huge and they’ve sent the share price soaring to new all-time highs – a win for MM and other holders, but a red flag from a political perspective at a time when the cost of living pressures are off the charts.

After XOM’s quarterly, President Biden said that unprecedented profit margins are unacceptable and called for “immediate action” to improve capacity. “At a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable.” Margins are high because Exxon has invested heavily in growing capacity but we suspect this message will be lost. Given this backdrop, we ponder whether or not XOM has now seen ‘peak earnings’ and more importantly, whether we should continue to hold the stock given the high chance of political intervention.