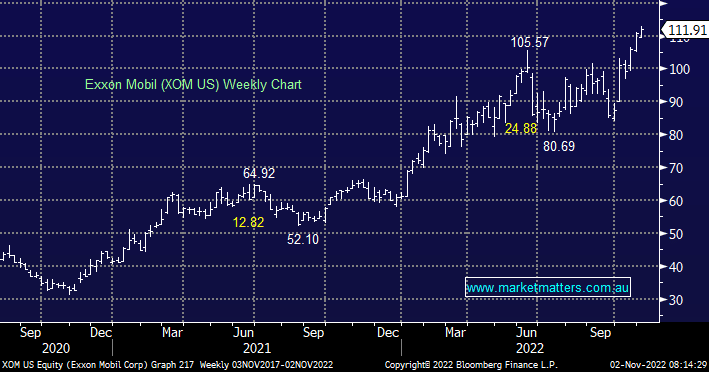

This week, Exxon Mobil reported the strongest-ever quarterly profit in its 152-year history and soon after, President Biden called for a levy tax on energy companies if they don’t use these high profits to bring down energy costs for consumers. While the stock prices didn’t really react to the news, this is a risk for energy companies around the globe as Governments grapple with the energy crisis. As the Chevron CEO pointed out, “Typically if you want less of something, you tax it,” implying that any tax would actually be counter-intuitive. Ultimately, massive underinvestment into global energy in recent years due to industry downturns, COVID, as well as policies centred on ending financing in fossil fuel projects, has been amplified by a war with no end in sight. This is a major issue that will not be resolved in the short term, the only real way to mitigate the impacts here is to own Energy producers such as Exxon and collect their quarterly dividends, which should continue to rise.

scroll

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish & long XOM US

Add To Hit List

Related Q&A

Why MM has reduced our energy exposure

3 international stocks that could run

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.