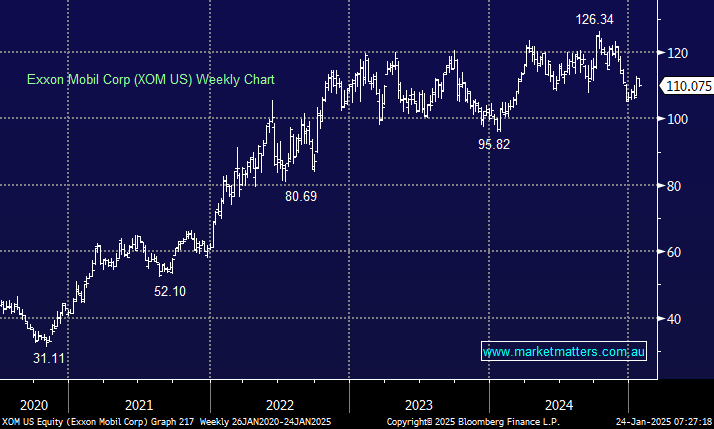

XOM has performed strongly since COVID, with its share price up four-fold and as 2024 showed, we are in a market which has paid dividends to investors staying with the strength. Even with a suppressed oil price last quarter, Exxon Mobil beat expectations, as the oil major reached its highest liquid production level in more than four decades. The underlying EPS beat of $1.92 vs. $1.88 per share expected, helped the producer return $9.8 billion to shareholders in the quarter and increase its fourth-quarter dividend to 99c. We regard the current pullback as an accumulation opportunity.

- We like XOM moving forward with $US100 obvious strong technical support: MM has added XOM to our Hitlist for our International Companies Portfolio.