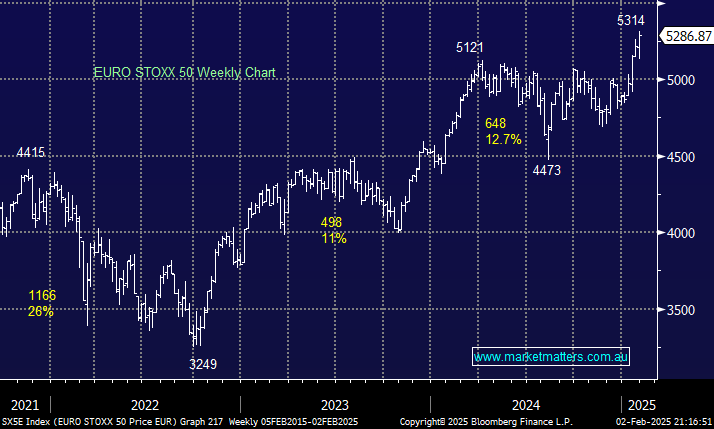

The ECB cut rates 0.25% last week and “bad news” is becoming “good news” for stocks with the EURO STOXX 50 surging to new highs. While the experience of being slow to address rising inflation will deter the ECB from adopting ultra-low rates, rates look set to fall further as ECB President Christine Lagarde said on Thursday that the euro area economy “is set to remain weak in the near term.” Trump’s tariffs are a clear fly in the ointment for all concerned over the coming months.

- We are bullish European indices into weakness but chasing into current strength considering the uncertain macro backdrop is fraught with danger.