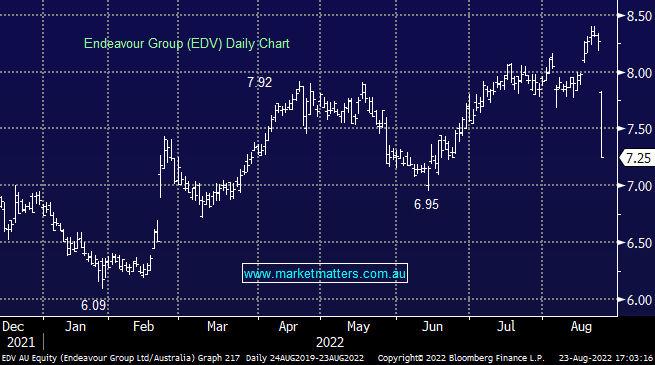

EDV -12.33%: The pub and bottle shop owner was hit today on their FY22 result that painted a mixed picture, their hotel’s division doing well while their retail business is a bit tougher as the reopening tailwinds are coming through more than expected i.e. more people getting out and about while the return of buying drinks and sitting at home due to rising cost of living has not yet occurred. They guided to a tough 1H23 with additional cost inflation (COVID, supply chain, tech investment in systems and digital, wages +4.5%, impact of Vic gaming taxes) with these trends more of an issue for their retail business. Not a lot to like in this result really with EBIT margins on the retail business sitting at just 6.6%.

scroll

Question asked

Question asked

Question asked

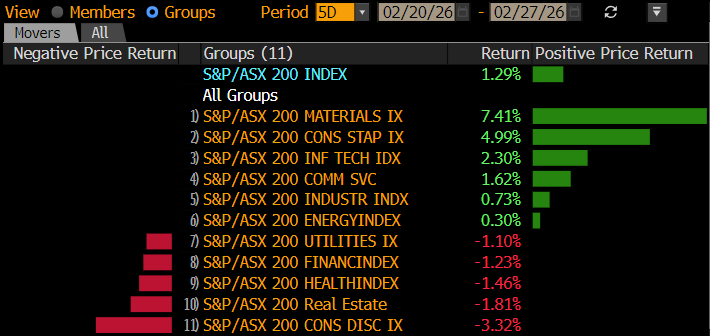

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is negative EDV ~$7.25

Add To Hit List

Related Q&A

Your view on several stocks

Does MM see value in Endeavour Group (EDV)?

Does MM like Endeavour Group (EDV)?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

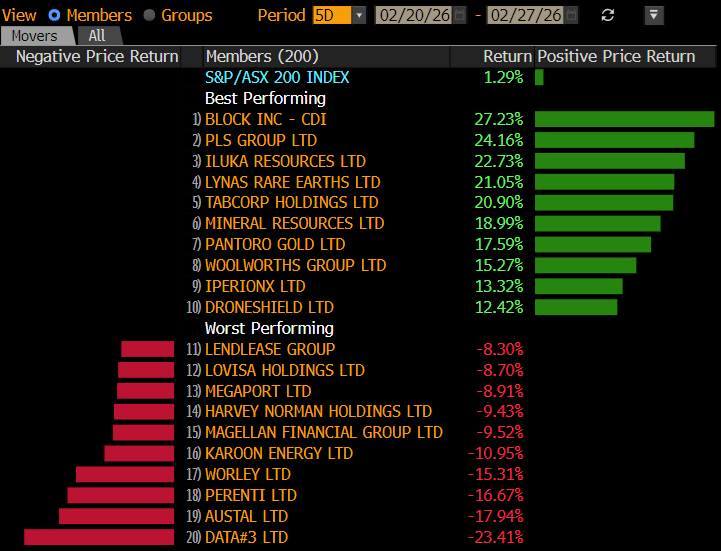

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.