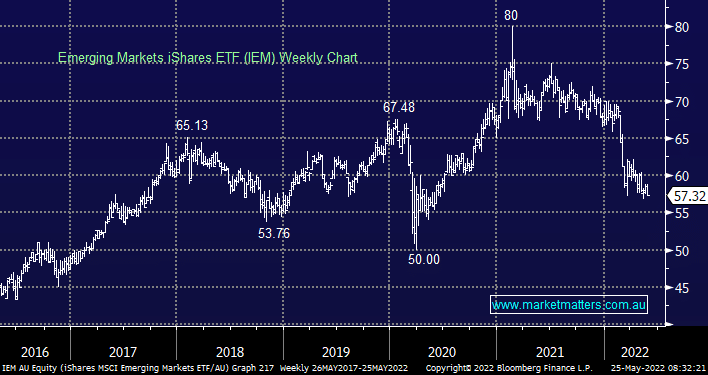

The IEM ETF has a significant correlation to the $US as well as global equities and if our assessment is accurate and the $US is set to correct and stocks bounce we should see a strong few months for emerging markets stocks sooner rather than later.

- Emerging market economies largely borrow funds in $US hence their interest bill falls if the $US drifts lower, and of course vice versa.

- Importantly while we are looking for a decent bounce by the IEM we are looking to exit into such strength.