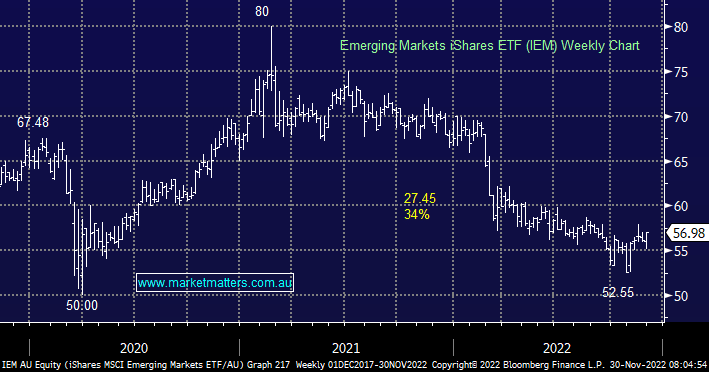

The Emerging Markets (IEM) ETF has corrected 34% over the last 18 months but in a similar fashion to our earlier discussions around Chinese stocks we can see the IEM trading 5-10% higher into Christmas – at this stage 28% of the ETF is made up of Chinese companies followed by India at 15% – the one headwind we are mindful of is if the $US bounces strongly from the 105 area because they have a clear inverse correlation.

- We are initially targeting a test of the $60 area, or 5% higher – it might be tempting to take a small profit if this eventuates and months of treading water.